Our activity in the market this week involved 8 new trades, specifically 8 buy(s) and 0 sell(s).

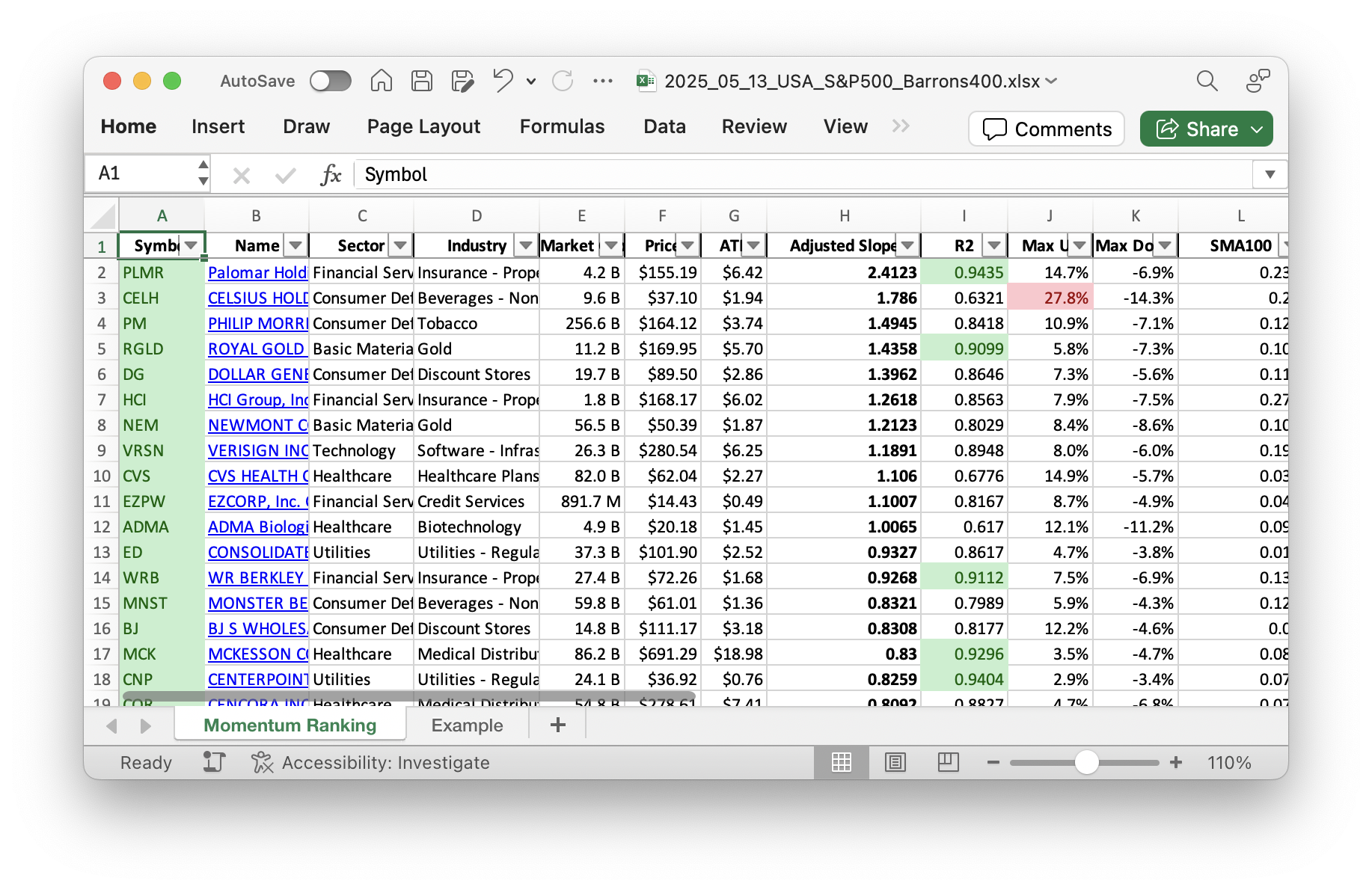

Want to stay on top of the market trends? Our Momentum Ranking report highlights the top stocks of the week, so you don’t have to! Click here to access the latest data for week 20.

This Week’s Trading Adventure

Hello, dear readers! This week, the market’s returning sparkle brought a dash of excitement. After being below the 200-day moving average for a while now, the S&P 500 has finally improved. Yay! It’s back above, allowing us to make some new investments. It’s been below the average for -21 days. Can you believe it? Let’s dive into what this means for our portfolio without any further ado.

Buys and Sells

This week we welcomed several new stocks into the portfolio. First up is Dollar General (DG), a big player in the consumer defensive sector. Its consistent performance in providing affordable goods makes it a great contender in our strategy. Next, we have HCI Group (HCI), part of the financial sector and our best performer of the week with a gain of over 10%! Then there’s McKesson Corporation (MCK), a health care services company that brings reliability and growth. Not to forget, Monster Beverage (MNST), another consumer defensive standout. It’s a company with some serious momentum behind its energy drinks.

We also added NewMarket Corporation (NEU), a specialty chemicals supplier known for its innovative products. Fellow newbie Palomar Holdings (PLMR) provides specialist insurance solutions that bolster our financial segment. Philip Morris International (PM), known for its global tobacco products, joins with a strong market presence. Lastly, W.R. Berkley Corporation (WRB), also from the financial sector, comes with a robust track record in insurance and reinsurance.

Portfolio Highlights

Our portfolio remains heavily tilted towards the consumer defensive sector, with stalwarts like UGI and returning pick NEU featuring prominently. In terms of performance, we had our stars and stragglers: while HCI soared with a 10.56% gain, LRN stumbled, posting a loss of 6.42%.

Overall, it’s been an eventful week. The market’s rebound above the 200-day threshold boosted our buying power. New entries like DG, MNST, and others added to our diversity—paving the way for potential gains. Looking ahead, maintaining our cash reserves gives us the flexibility to act quickly. We’d love to hear your thoughts on our latest moves. Have questions or comments? Don’t hesitate to share!

This week’s transactions:

-

Rebalanced / added:

- No positions were added to in this week!

-

Rebalanced / reduced:

- No positions were reduced in this week!

Index Distribution:

Our biggest stock holdings at the moment are in the S&P 500 category.

Current portfolio allocation:

Our portfolio is currently dominated by the Consumer Defensive sector.

Weekly sector distribution:

Current portfolio (@finviz):

| Symbol | Name | Index | Sector | MC | Dist to 52w High | pct |

|---|---|---|---|---|---|---|

| UGI | UGI Corp | S&P 400 | Utilities | 7.45B | -1.88% | 0.108 |

| NEU | NewMarket Corp | S&P 400 | Basic Materials | 6.02B | -1.07% | 0.099 |

| MNST | Monster Beverage Corp | S&P 500 | Consumer Defensive | 59.26B | -2.70% | 0.093 |

| PM | Philip Morris International Inc | S&P 500 | Consumer Defensive | 255.60B | -6.96% | 0.09 |

| WRB | W.R. Berkley Corp | S&P 500 | Financial Services | 27.44B | -5.32% | 0.089 |

| LRN | Stride Inc | Barrons 400 | Consumer Defensive | 6.70B | -5.12% | 0.079 |

| MCK | Mckesson Corporation | S&P 500 | Healthcare | 86.37B | -5.24% | 0.067 |

| OSIS | OSI Systems, Inc | Barrons 400 | Technology | 3.87B | -1.34% | 0.066 |

| DG | Dollar General Corp | S&P 500 | Consumer Defensive | 19.50B | -40.05% | 0.065 |

| VRSN | Verisign Inc | S&P 500 | Technology | 26.35B | -2.87% | 0.06 |

| PLMR | Palomar Holdings Inc | Barrons 400 | Financial Services | 4.15B | -5.93% | 0.048 |

| HCI | HCI Group Inc | Barrons 400 | Financial Services | 1.91B | -6.11% | 0.038 |

| PLTR | Palantir Technologies Inc | S&P 500 | Technology | 298.37B | 0.81% | 0.035 |

| cash | Cash | Cash | Cash | – | 1699 | 0.033 |

| PEN | Penumbra Inc | S&P 400 | Healthcare | 11.58B | -3.54% | 0.029 |

As always, more trades next week!