We held steady this week with no new trades.

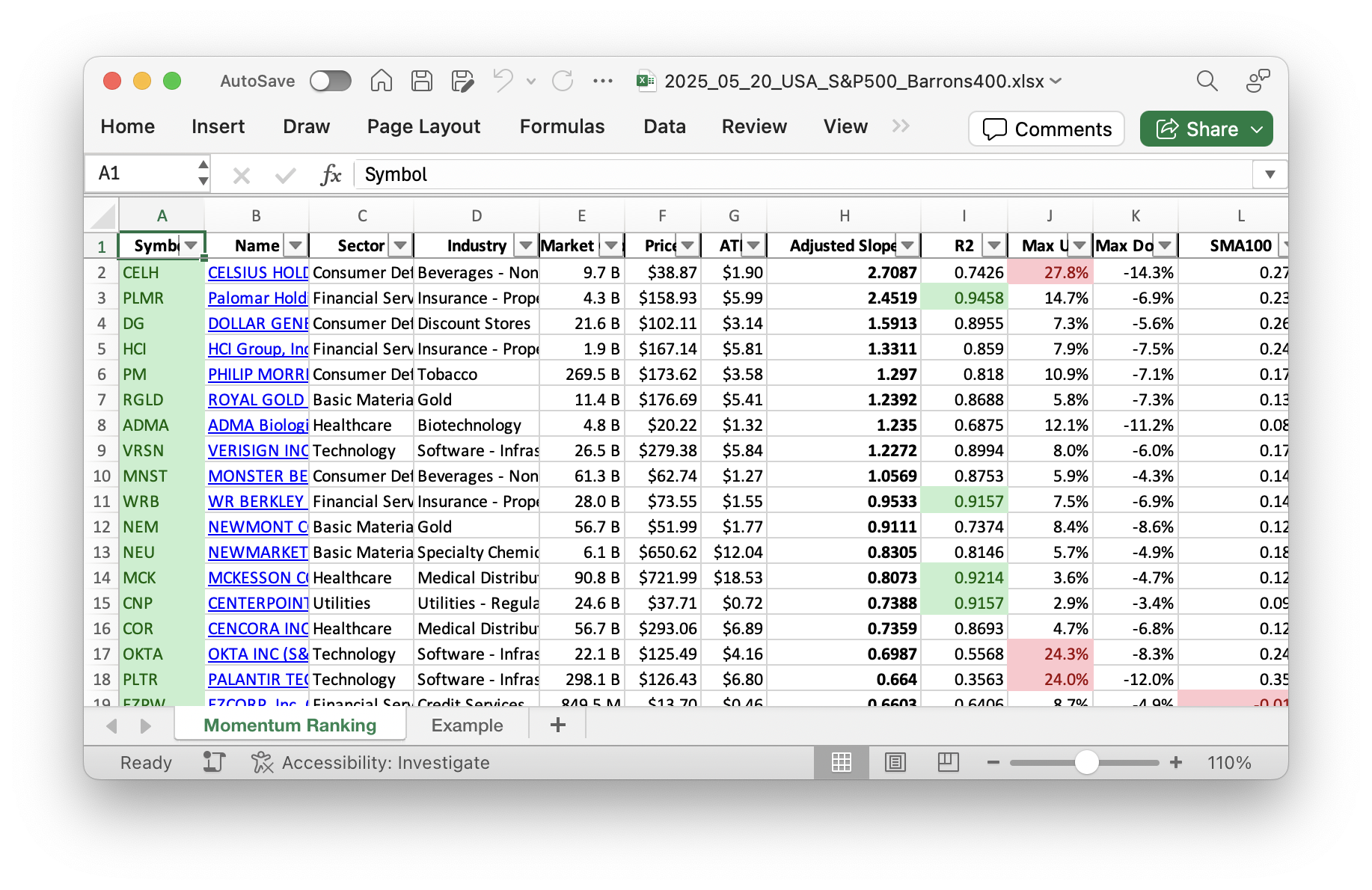

Whether you’re an investor or just interested in the stock market, our weekly Momentum Ranking report based on Andreas Clenow’s book Stocks on the Move is a must-read! Click here to access the latest data for week 21 and stay up-to-date on the top performers.

This Week’s Trading Activity: A Quick Overview

Hello there! This week, our portfolio remained nearly fully invested, with a focus on the Consumer Defensive sector. Shares like NEU, VRSN, and UGI continue to play a significant role in our strategy. This sector, known for its stability, gives us a solid foundation, especially during uncertain market periods. Although we saw some fluctuations, Consumer Defensive stocks have shown resilience, contributing to our steady performance.

Buys & Sells: What’s new?

This week, we took the opportunity to rebalance our portfolio. We increased our position in Verisign (VRSN), an Internet and Software Services company. It was a strategic move as VRSN continues to show promise with its consistent growth. On the other hand, we reduced our stake in Stride, Inc. (LRN), an Education Services company, and UGI Corporation (UGI), from the Utilities sector. These adjustments were made with a keen eye on maintaining optimal momentum in our portfolio.

While the market’s been under some stress, with the S&P 500 trading below its 200-day moving average for the last -22 days, we’ve refrained from new purchases, as per our strategy indicated in Andreas Clenow’s ‘Stocks On The Move’. Instead, we’ve moderated our portfolio to ensure maximum efficiency and compliance with our system.

Summary & Weekly Insights

In the last seven days, Palantir Technologies (PLTR) was our best-performing stock, gaining an impressive 7.70%. On the downside, Penske Automotive Group (PEN) experienced a drop of 5.30%, underlining the week’s mixed bag of outcomes. Despite these swings, our prudent approach—focusing mainly on Consumer Defensive stocks—has allowed us to navigate the ups and downs effectively.

To wrap up, this week’s trading activity focused on strategic rebalancing and making sure our portfolio only includes the best-ranked stocks by annualized adjusted slope. We’re keeping our strategy clear and steady, in line with the book’s recommendations. If you have any thoughts or questions about this week’s trades, feel free to drop a comment below. We’d love to hear from you!

This week’s transactions:

-

Sold:

- No sells in this week!

-

Bought:

- No buys in this week!

-

Rebalanced / added:

-

Rebalanced / reduced:

Index Distribution:

We’re mainly invested in stocks from the S&P 500 group at the moment.

Current portfolio allocation:

Currently, the Consumer Defensive sector is the main player in our portfolio.

Weekly sector distribution:

Current portfolio (@finviz):

| Symbol | Name | Index | Sector | MC | Dist to 52w High | pct |

|---|---|---|---|---|---|---|

| NEU | NewMarket Corp | S&P 400 | Basic Materials | 6.13B | -0.46% | 0.098 |

| VRSN | Verisign Inc | S&P 500 | Technology | 26.29B | -3.09% | 0.096 |

| UGI | UGI Corp | S&P 400 | Utilities | 7.76B | 0.56% | 0.093 |

| MNST | Monster Beverage Corp | S&P 500 | Consumer Defensive | 61.17B | -0.38% | 0.092 |

| PM | Philip Morris International Inc | S&P 500 | Consumer Defensive | 269.94B | -1.74% | 0.091 |

| WRB | W.R. Berkley Corp | S&P 500 | Financial Services | 27.86B | -3.84% | 0.088 |

| DG | Dollar General Corp | S&P 500 | Consumer Defensive | 22.45B | -30.94% | 0.068 |

| MCK | Mckesson Corporation | S&P 500 | Healthcare | 89.90B | -1.36% | 0.068 |

| OSIS | OSI Systems, Inc | Barrons 400 | Technology | 3.86B | -1.55% | 0.065 |

| LRN | Stride Inc | Barrons 400 | Consumer Defensive | 6.82B | -3.51% | 0.056 |

| PLMR | Palomar Holdings Inc | Barrons 400 | Financial Services | 4.25B | -3.70% | 0.049 |

| HCI | HCI Group Inc | Barrons 400 | Financial Services | 1.93B | -5.22% | 0.038 |

| PLTR | Palantir Technologies Inc | S&P 500 | Technology | 298.07B | -5.38% | 0.036 |

| cash | Cash | Cash | Cash | – | 1854 | 0.035 |

| PEN | Penumbra Inc | S&P 400 | Healthcare | 10.92B | -9.01% | 0.027 |

As always, more trades next week!