We didn’t make any new trades this week.

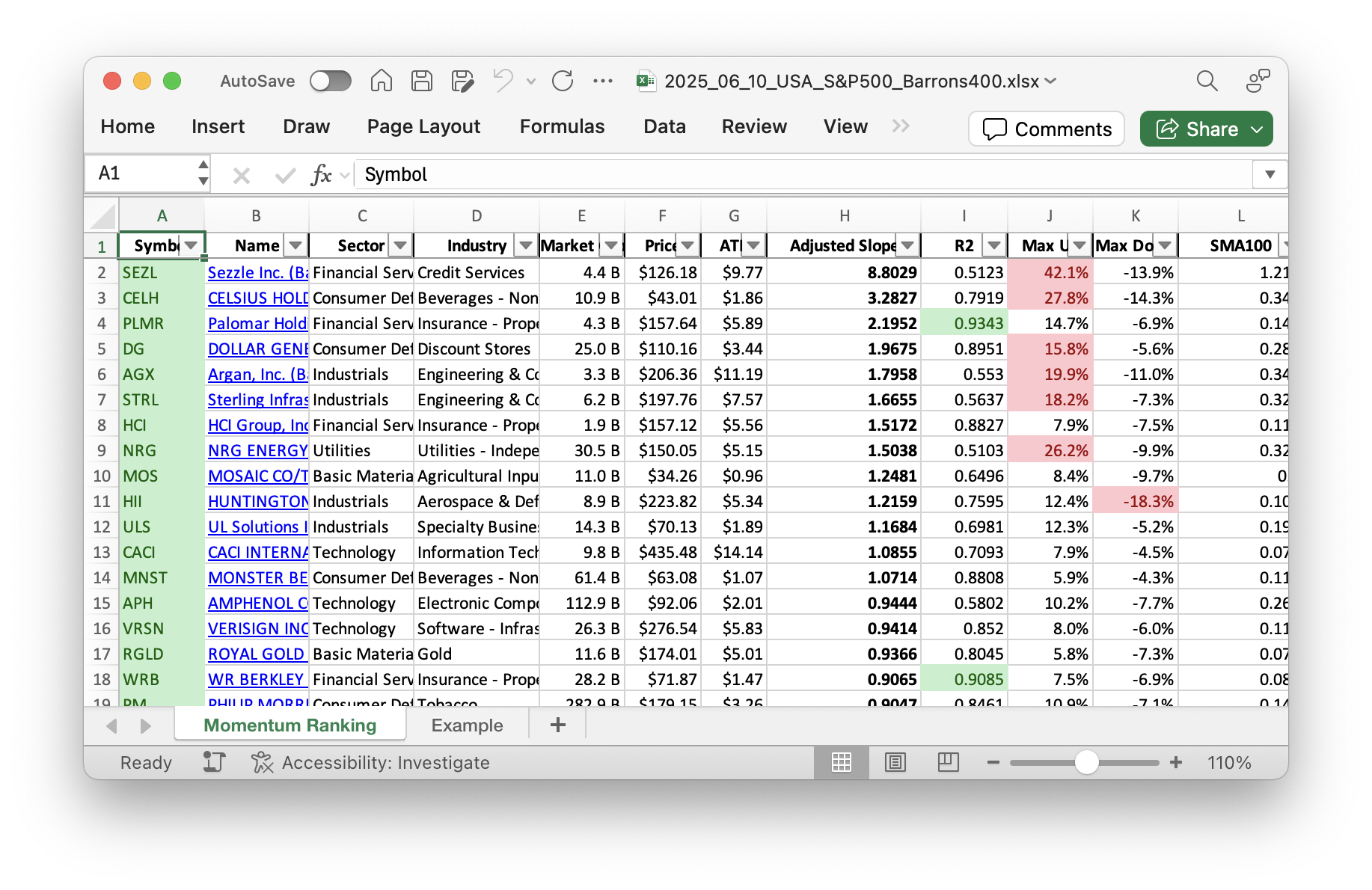

Get ahead of the game with our weekly Momentum Ranking report! Click here to see the top stocks for week 24.

Weekly Trading Activity Report

As we step into a new week, the financial landscape remains relatively uneventful for our momentum-based portfolio. Currently, the S&P 500 has been above its 200-day moving average for 21 days. This provides us with a positive regime filter, allowing for potential new entries and adjustments. However, this week we found ourselves almost fully invested, holding just about 0.22% in cash. Despite the market’s capacity for new buys, the strategy guided us to maintain our current course without introducing any new stocks or making any sales.

Inactive But Steady

The largest sector in our portfolio remains Financial Services. This sector plays a critical role in providing consistent momentum, delivering stability in times of market flux. Financial Services often act as a backbone for our portfolio with their robust earnings and adaptability to market trends. Although the portfolio has seen no rebalancing or adjustment within this sector, it continues to provide a solid foundation.

No changes this week reflect our adherence to the strict momentum ranking approach described by Andreas Clenow in his book “Stocks On The Move.” By following this strategy, we ensure that only the top-ranked stocks remain in our portfolio, safeguarding against unnecessary churn even during quiet periods.

Portfolio Highlights

Now, let’s take a closer look at some of our top holdings. Rollins, Inc. (ROL) stands out as a resilient player in the service sector, maintaining its position due to steady growth. Similarly, Monster Beverage Corporation (MNST) and CenterPoint Energy, Inc. (CNP) continue to show strength and adaptability within their respective sectors. These companies have solidified their spots in our portfolio, ensuring we’re aligned with enduring market trends.

Interestingly, our standout performance over the past 7 days came from Dollar General (DG), which showed an impressive gain of 14.49%. On the flip side, Stride, Inc. (LRN) experienced a challenging week, with a decrease of 11.82%. While market fluctuations are inevitable, our strategy is designed to minimize their impact on our overall performance.

Wrapping Up

In conclusion, this week’s trading activity was marked by stability and adherence to our momentum-based strategy. While there were no new trades to report, the portfolio remains strong, heavily weighted in the Financial Services sector. Our top performers continue to shine, contributing to our overall market resilience. We invite you to share your thoughts or queries in the comments section below. Your engagement and questions enrich our discussions and help us all grow as investors.

This week’s transactions:

-

Sold:

- No sells in this week!

-

Bought:

- No buys in this week!

-

Rebalanced / added:

- No positions were added to in this week!

-

Rebalanced / reduced:

- No positions were reduced in this week!

Index Distribution:

The majority of our portfolio is currently made up of stocks from the S&P 500 sector.

Current portfolio allocation:

The biggest share of our portfolio is currently allocated to the Financial Services sector.

Weekly sector distribution:

Current portfolio (@finviz):

| Symbol | Name | Index | Sector | MC | Dist to 52w High | pct |

|---|---|---|---|---|---|---|

| ROL | Rollins, Inc | S&P 500 | Consumer Cyclical | 27.56B | -3.03% | 0.053 |

| MNST | Monster Beverage Corp | S&P 500 | Consumer Defensive | 61.48B | -2.19% | 0.053 |

| CNP | Centerpoint Energy Inc | S&P 500 | Utilities | 23.66B | -7.77% | 0.052 |

| PM | Philip Morris International Inc | S&P 500 | Consumer Defensive | 278.66B | -2.67% | 0.051 |

| CME | CME Group Inc | S&P 500 | Financial Services | 95.89B | -8.49% | 0.051 |

| NEU | NewMarket Corp | S&P 400 | Basic Materials | 6.23B | 0.60% | 0.05 |

| NFG | National Fuel Gas Co | S&P 400 | Energy | 7.41B | -2.68% | 0.05 |

| UGI | UGI Corp | S&P 400 | Utilities | 7.73B | -1.31% | 0.049 |

| WRB | W.R. Berkley Corp | S&P 500 | Financial Services | 27.24B | -6.00% | 0.048 |

| VRSN | Verisign Inc | S&P 500 | Technology | 26.15B | -3.62% | 0.048 |

| EHC | Encompass Health Corp | S&P 400 | Healthcare | 12.02B | -3.17% | 0.048 |

| COR | Cencora Inc | S&P 500 | Healthcare | 55.09B | -8.12% | 0.043 |

| MCK | Mckesson Corporation | S&P 500 | Healthcare | 88.19B | -3.58% | 0.04 |

| DG | Dollar General Corp | S&P 500 | Consumer Defensive | 24.48B | -17.88% | 0.038 |

| PLTR | Palantir Technologies Inc | S&P 500 | Technology | 313.39B | -1.83% | 0.038 |

| FCFS | FirstCash Holdings Inc | S&P 400 | Financial Services | 5.85B | -2.68% | 0.038 |

| HII | Huntington Ingalls Industries Inc | S&P 500 | Industrials | 8.76B | -21.87% | 0.034 |

| ULS | UL Solutions Inc | Barrons 400 | Industrials | 14.06B | -3.67% | 0.033 |

| RGLD | Royal Gold, Inc | S&P 400 | Basic Materials | 11.43B | -9.45% | 0.033 |

| NEM | Newmont Corp | S&P 500 | Basic Materials | 58.50B | -10.49% | 0.032 |

| PLMR | Palomar Holdings Inc | Barrons 400 | Financial Services | 4.20B | -10.79% | 0.027 |

| LRN | Stride Inc | Barrons 400 | Consumer Defensive | 6.08B | -13.89% | 0.027 |

| OSIS | OSI Systems, Inc | Barrons 400 | Technology | 3.89B | -1.27% | 0.026 |

| ADMA | Adma Biologics Inc | Barrons 400 | Healthcare | 4.98B | -18.74% | 0.018 |

| HCI | HCI Group Inc | Barrons 400 | Financial Services | 1.80B | -11.63% | 0.018 |

| cash | Cash | Cash | Cash | – | 118 | 0.002 |

As always, more trades next week!