We made 4 new trades this week, consisting of 3 buy(s) and 1 sell(s).

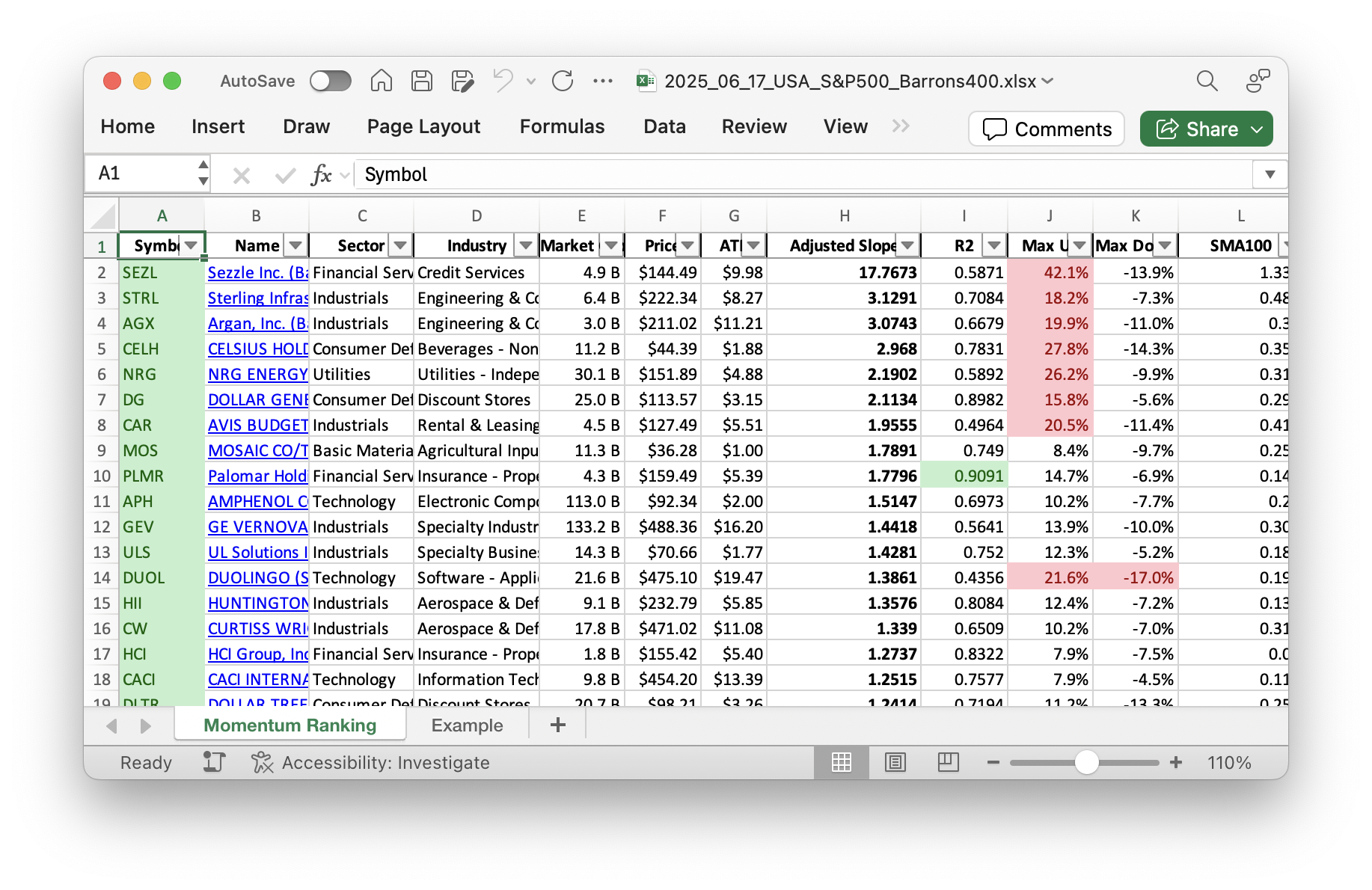

Whether you’re an investor or just interested in the stock market, our weekly Momentum Ranking report based on Andreas Clenow’s book Stocks on the Move is a must-read! Click here to access the latest data for week 25 and stay up-to-date on the top performers.

Introduction

This week, the portfolio welcomed some new additions while saying goodbye to others. With the S&P500 trading above its 200-day moving average for 26 days, we’ve had the chance to be a bit more flexible in our trading activities. That allows us to be strategic with maintaining our current positions and adding new ones. This week, we’re almost fully invested, holding just about 1.06% in cash reserves. It’s good to be back in a buying mode while keeping an eye on how the market moves.

Buys/Sells

In terms of buys, we added three new stocks to the portfolio. AGX (Argan Inc.), a player in the industrial services sector, has been brought on for its strong growth potential. Though AGX has had a tough week with a -10.09% drop, we’re in this for the long haul. MOS (The Mosaic Company), from the basic materials sector, joins us due to its market position and the rising demand for its phosphate and potash products. Rounding out the new buys is STRL (Sterling Infrastructure, Inc.), another industrial sector company that’s poised to benefit from increased infrastructure spending.

On the selling side, we part ways with ADMA (ADMA Biologics, Inc.). It’s always a calculated decision to offload a stock, and in this case, ADMA no longer fit our criteria after dropping out of the top 10% momentum ranking.

For existing positions, we rebalanced and added to CME (CME Group Inc.), CNP (CenterPoint Energy, Inc.), and ROL (Rollins, Inc.). It’s all part of fine-tuning our portfolio balance in response to changing market dynamics.

Summary

The Consumer Defensive sector is playing a significant role in our portfolio, providing stability amid market fluctuations. This sector is known for its resilience, making it an essential component during uncertain economic times. Top holdings such as MNST (Monster Beverage Corp.), PM (Philip Morris International Inc.), and NFG (National Fuel Gas Co.) bolster our portfolio with their solid market positions and consistent performance. However, the standout performer this week was NEM (Newmont Corporation), which delivered an impressive gain of 11.00%.

In summary, this week’s trading was a mix of strategic buying and mindful rebalancing. Our performance remains solid as we continue to optimize our portfolio. Feel free to share your thoughts or questions in the comments below—engaging with your insights always enriches our trading community.

This week’s transactions:

Index Distribution:

The S&P 500 sector is where most of our investments are right now.

Current portfolio allocation:

The Consumer Defensive sector now has the largest share in the portfolio:

Weekly sector distribution:

Current portfolio (@finviz):

| Symbol | Name | Index | Sector | MC | Dist to 52w High | pct |

|---|---|---|---|---|---|---|

| MNST | Monster Beverage Corp | S&P 500 | Consumer Defensive | 61.29B | -2.50% | 0.053 |

| PM | Philip Morris International Inc | S&P 500 | Consumer Defensive | 286.15B | -1.53% | 0.052 |

| NFG | National Fuel Gas Co | S&P 400 | Energy | 7.64B | -0.09% | 0.05 |

| WRB | W.R. Berkley Corp | S&P 500 | Financial Services | 27.69B | -4.44% | 0.048 |

| NEU | NewMarket Corp | S&P 400 | Basic Materials | 6.00B | -5.22% | 0.048 |

| UGI | UGI Corp | S&P 400 | Utilities | 7.76B | -1.12% | 0.048 |

| EHC | Encompass Health Corp | S&P 400 | Healthcare | 12.02B | -3.16% | 0.048 |

| VRSN | Verisign Inc | S&P 500 | Technology | 26.68B | -1.67% | 0.048 |

| COR | Cencora Inc | S&P 500 | Healthcare | 56.91B | -5.08% | 0.044 |

| MCK | Mckesson Corporation | S&P 500 | Healthcare | 90.60B | -1.21% | 0.041 |

| PLTR | Palantir Technologies Inc | S&P 500 | Technology | 327.53B | -4.19% | 0.04 |

| DG | Dollar General Corp | S&P 500 | Consumer Defensive | 24.98B | -16.22% | 0.038 |

| FCFS | FirstCash Holdings Inc | S&P 400 | Financial Services | 5.76B | -4.18% | 0.037 |

| MOS | Mosaic Company | S&P 500 | Basic Materials | 11.46B | -4.13% | 0.036 |

| NEM | Newmont Corp | S&P 500 | Basic Materials | 65.16B | -0.39% | 0.035 |

| HII | Huntington Ingalls Industries Inc | S&P 500 | Industrials | 9.20B | -17.99% | 0.034 |

| RGLD | Royal Gold, Inc | S&P 400 | Basic Materials | 11.86B | -6.05% | 0.034 |

| ULS | UL Solutions Inc | Barrons 400 | Industrials | 14.20B | -2.72% | 0.034 |

| ROL | Rollins, Inc | S&P 500 | Consumer Cyclical | 27.36B | -3.75% | 0.031 |

| CNP | Centerpoint Energy Inc | S&P 500 | Utilities | 23.35B | -8.99% | 0.028 |

| PLMR | Palomar Holdings Inc | Barrons 400 | Financial Services | 4.27B | -9.13% | 0.027 |

| LRN | Stride Inc | Barrons 400 | Consumer Defensive | 6.29B | -10.92% | 0.027 |

| OSIS | OSI Systems, Inc | Barrons 400 | Technology | 3.77B | -6.98% | 0.026 |

| CME | CME Group Inc | S&P 500 | Financial Services | 97.31B | -7.14% | 0.025 |

| STRL | Sterling Infrastructure Inc | Barrons 400 | Industrials | 6.78B | 5.22% | 0.024 |

| HCI | HCI Group Inc | Barrons 400 | Financial Services | 1.79B | -12.22% | 0.017 |

| AGX | Argan, Inc | Barrons 400 | Industrials | 2.90B | -13.93% | 0.016 |

| cash | Cash | Cash | Cash | – | 564 | 0.011 |

As always, more trades next week!