Our market activity this week included 9 new trades: 5 buy(s) and 4 sell(s).

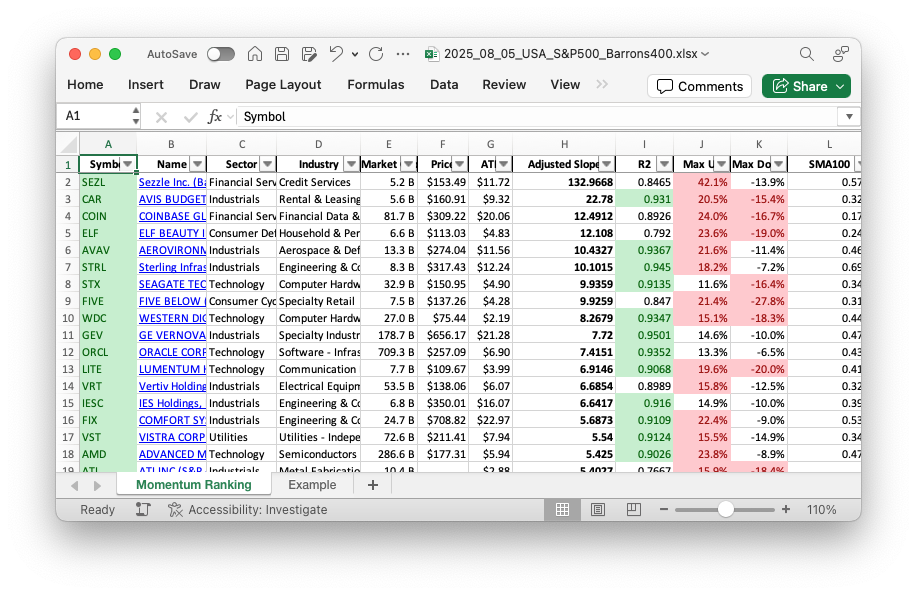

Click here for the Momentum Ranking of week 32.

Momentum Portfolio Weekly Update: Navigating the Markets with Precision

As we dive into this week’s trading update, the stock market continues to navigate past its critical 51-day mark above the S&P 500’s 200-day moving average. This indicates a positive regime, allowing us to confidently adjust our portfolio with strategic moves. With a cash share of just 3.49%, we’re nearly fully invested, taking calculated risks to drive growth.

Buys and Sells: Strategic Portfolio Moves

This week, we’ve chosen to introduce five stocks to our portfolio: AVGO and FLEX are tech sector stalwarts, promising to add momentum-driven growth. FN, a financial sector player, aims to diversify our holdings, while RCL and VRT in the consumer and tech sectors continue to align with our momentum strategy. Notably, we’re parting ways with ATI, DG, HII, and ULS due to their declining momentum rankings or other strategic considerations.

In line with our strategy from Stocks On The Move by Andreas Clenow, we sell any holdings that lose their top 10% momentum position or fall below their 100-day moving average. This disciplined approach ensures our portfolio remains robust and centered on performance.

Summary: Technology Leads the Charge

This week’s portfolio is led by the dynamic technology sector, renowned for pushing the boundaries of innovation and growth. It’s no surprise that our top holdings now include NEU, JBL, and ORCL, showcasing our commitment to sectors with high momentum potential. Meanwhile, VST emerges as the best performer with an impressive 11.37% gain, whereas RCL took a hit, marking a 10.52% drop.

We’re delighted to report that the Momentum Portfolio saw a 7.3% increase in July, culminating in a year-to-date gain of 16.2%, with STRL showing excellent performance. We invite you to reflect on these updates and share your thoughts about the market and our strategy in the comments below.

This week’s transactions:

-

Rebalanced / added:

- No positions were added to in this week!

-

Rebalanced / reduced:

- No positions were reduced in this week!

Index Distribution:

The S&P 500 index is currently contributing the most to our portfolio.

Current portfolio allocation:

The Technology sector now has the largest share in the portfolio:

Weekly sector distribution:

Current portfolio (@finviz):

| Symbol | Name | Index | Sector | MC | Dist to 52w High | pct |

|---|---|---|---|---|---|---|

| NEU | NewMarket Corp | S&P 400 | Basic Materials | 6.65B | -4.76% | 0.104 |

| JBL | Jabil Inc | S&P 500 | Technology | 23.62B | -5.47% | 0.082 |

| ORCL | Oracle Corp | S&P 500 | Technology | 718.47B | -1.95% | 0.079 |

| MOS | Mosaic Company | S&P 500 | Basic Materials | 11.32B | -6.68% | 0.074 |

| FLEX | Flex Ltd | S&P 400 | Technology | 19.00B | -6.21% | 0.071 |

| AVGO | Broadcom Inc | S&P 500 | Technology | 1381.08B | -4.34% | 0.071 |

| FN | Fabrinet | S&P 400 | Technology | 11.74B | -1.46% | 0.067 |

| GEV | GE Vernova Inc | S&P 500 | Industrials | 177.11B | -3.94% | 0.061 |

| STRL | Sterling Infrastructure Inc | Barrons 400 | Industrials | 9.03B | 8.88% | 0.055 |

| FIX | Comfort Systems USA, Inc | S&P 400 | Industrials | 24.42B | -3.64% | 0.051 |

| VST | Vistra Corp | S&P 500 | Utilities | 71.06B | -2.65% | 0.051 |

| IESC | IES Holdings Inc | Barrons 400 | Industrials | 6.66B | -9.56% | 0.05 |

| VRT | Vertiv Holdings Co | Barrons 400 | Industrials | 53.09B | -10.79% | 0.046 |

| PLTR | Palantir Technologies Inc | S&P 500 | Technology | 408.38B | 7.22% | 0.041 |

| AGX | Argan, Inc | Barrons 400 | Industrials | 3.16B | -8.59% | 0.037 |

| cash | Cash | Cash | Cash | – | - | 0.035 |

| RCL | Royal Caribbean Group | S&P 500 | Consumer Cyclical | 84.46B | -12.64% | 0.023 |

As always, more trades next week!