There were no new trades in this week

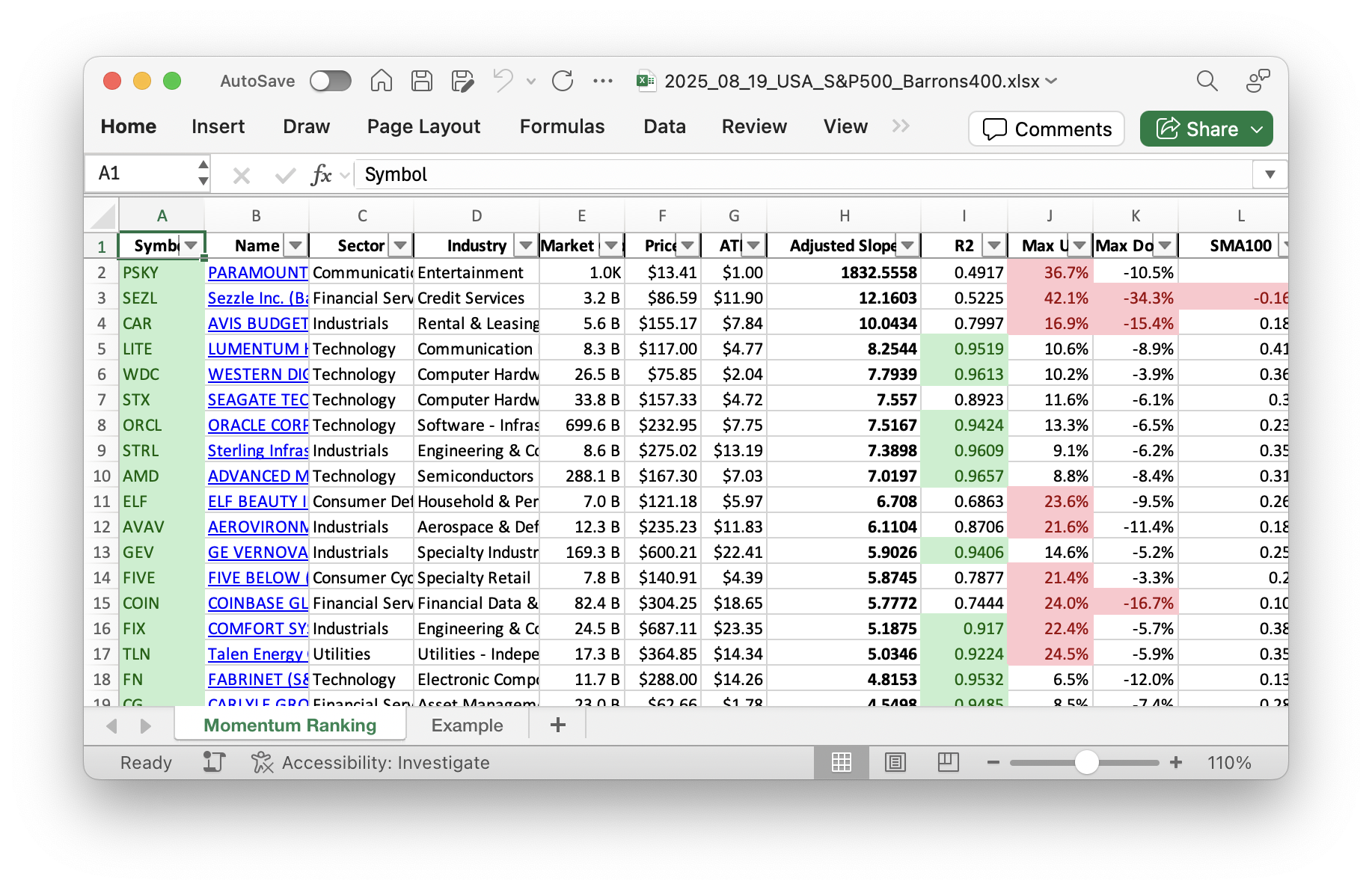

Whether you’re an investor or just interested in the stock market, our weekly Momentum Ranking report based on Andreas Clenow’s book Stocks on the Move is a must-read! Click here to access the latest data for week 34 and stay up-to-date on the top performers.

Market Overview and Strategy Update

This past week has seen a healthy streak for the S&P 500, showing 69 days trading above its 200-day moving average. This signals a positive market environment, allowing us to make strategic adjustments where necessary. With a cash share of only about 2.93%, we are nearly fully invested, reflecting confidence in our current portfolio structure. Our strategy, inspired by Andreas Clenow’s ‘Stocks On The Move’, emphasizes momentum ranking through the adjusted slope to ensure that our selections remain aligned with trends.

Weekly Portfolio Moves

This week was quiet on the buying and selling front—no new positions were added to or removed entirely from our portfolio. Instead, we focused on rebalancing, tweaking existing holdings to better align with our momentum strategy.

We added to our existing position in CCL, NVDA, and RCL, following their continued demonstration of strong performance potential in line with our momentum ranking criteria. Simultaneously, we trimmed our position in FN, JBL, ORCL, and STRL, aligning to quarterly recalibrations and keeping our risk-reward perspectives optimal.

Portfolio Summary

Technology remains our top sector, known for driving innovation and growth, making it a significant component in many portfolios. Our top holdings now include NVDA, AVGO, and FLEX, showcasing our focus on forward-moving companies across various industries. The best performer this week was RCL, with a notable gain of 8.41%, whereas PLTR ended up as the worst performer, seeing a decline of 6.92%.

Given that we are almost fully invested, we’re positioned to capitalize on potential market upswings, while our strategy ensures we remain agile and data-informed.

Feel free to share your thoughts on this week’s strategy in the comments below!

This week’s transactions:

-

Sold:

- No sells in this week!

-

Bought:

- No buys in this week!

-

Rebalanced / added:

-

Rebalanced / reduced:

Index Distribution:

We’re mainly invested in stocks from the S&P 500 group at the moment.

Current portfolio allocation:

Right now, we’ve got a big chunk of our portfolio in the Technology sector.

Weekly sector distribution:

Current portfolio (@finviz):

| Symbol | Name | Index | Sector | MC | Dist to 52w High | pct |

|---|---|---|---|---|---|---|

| NVDA | NVIDIA Corp | S&P 500 | Technology | 4300.69B | -4.46% | 0.082 |

| AVGO | Broadcom Inc | S&P 500 | Technology | 1388.61B | -6.97% | 0.074 |

| FLEX | Flex Ltd | S&P 400 | Technology | 18.70B | -7.66% | 0.071 |

| CCL | Carnival Corp | S&P 500 | Consumer Cyclical | 38.55B | -4.46% | 0.069 |

| EL | Estee Lauder Cos., Inc | S&P 500 | Consumer Defensive | 32.41B | -12.90% | 0.066 |

| FIX | Comfort Systems USA, Inc | S&P 400 | Industrials | 24.27B | -6.20% | 0.065 |

| RCL | Royal Caribbean Group | S&P 500 | Consumer Cyclical | 90.01B | -6.89% | 0.061 |

| ORCL | Oracle Corp | S&P 500 | Technology | 657.74B | -10.23% | 0.061 |

| GEV | GE Vernova Inc | S&P 500 | Industrials | 163.64B | -11.24% | 0.058 |

| IESC | IES Holdings Inc | Barrons 400 | Industrials | 6.46B | -12.26% | 0.05 |

| VST | Vistra Corp | S&P 500 | Utilities | 65.52B | -10.83% | 0.048 |

| VRT | Vertiv Holdings Co | Barrons 400 | Industrials | 49.14B | -17.42% | 0.046 |

| PLTR | Palantir Technologies Inc | S&P 500 | Technology | 374.78B | -16.85% | 0.046 |

| FN | Fabrinet | S&P 400 | Technology | 10.28B | -19.52% | 0.043 |

| AGX | Argan, Inc | Barrons 400 | Industrials | 2.95B | -14.92% | 0.038 |

| STRL | Sterling Infrastructure Inc | Barrons 400 | Industrials | 8.41B | -14.06% | 0.037 |

| JBL | Jabil Inc | S&P 500 | Technology | 22.15B | -11.37% | 0.032 |

| cash | Cash | Cash | Cash | – | - | 0.029 |

| ALGM | Allegro Microsystems Inc | S&P 400 | Technology | 5.66B | -20.42% | 0.024 |

As always, more trades next week!