This week, we executed 2 new trades, including 2 buy(s) and 0 sell(s).

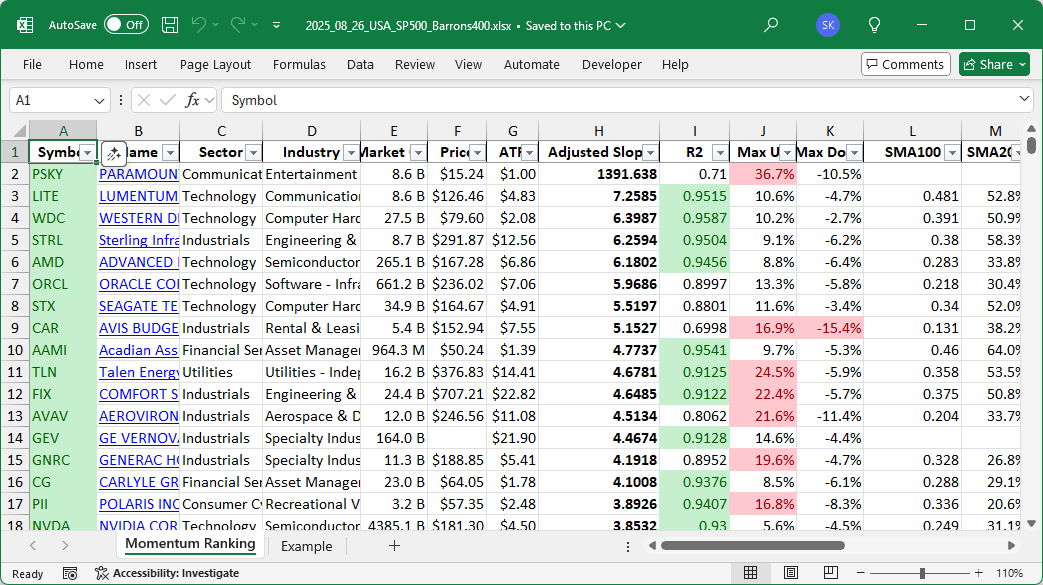

Click here for the Momentum Ranking of week 35.

Weekly Portfolio Update: S&P 500 Momentum and Our Latest Moves

This week, we’re diving into the latest actions in our portfolio against the backdrop of a rising market. With the S&P 500 staying above its 200-day moving average for the past 74 days, this positive trend allows us to fully engage in new investment opportunities. With a cash share of just 0.0019%, we’re more or less fully invested, seizing the current favorable market conditions.

Portfolio Trades:

New Buys: We have welcomed AMD into our portfolio, a leading player in the Technology sector known for its robust processors and graphics cards. Alongside, LITE, also from the vibrant Tech sector, brings innovative optical and photonics solutions to the table. These additions have been selected based on their strong momentum rankings.

Rebalanced Stocks: We added to our existing position in ALGM to further bolster our technology exposure. Conversely, we trimmed our positions in FIX, ORCL, PLTR, VRT, and VST to keep our portfolio aligned with our momentum strategy.

Summary: Our top sector continues to be Technology, reflecting the sector’s essential role in driving growth and innovation within our portfolio. Our top holdings include the stalwarts NVDA, FLEX, and CCL, showcasing our strategic diversity across different fields. This week, RCL emerged as our best performer with an impressive gain of +9.88%, while PLTR faced challenges, decreasing by -11.29%.

Your Insights Matter: As we navigate through these dynamic markets, your perspectives are invaluable. Share your thoughts or questions in the comments below.

This week’s transactions:

Index Distribution:

The S&P 500 sector is where most of our investments are right now.

Current portfolio allocation:

We’re heavily invested in the Technology sector at the moment.

Weekly sector distribution:

Current portfolio (@finviz):

| Symbol | Name | Index | Sector | MC | Dist to 52w High | pct |

|---|---|---|---|---|---|---|

| NVDA | NVIDIA Corp | S&P 500 | Technology | 4446.41B | -1.22% | 0.081 |

| FLEX | Flex Ltd | S&P 400 | Technology | 20.15B | -0.52% | 0.076 |

| CCL | Carnival Corp | S&P 500 | Consumer Cyclical | 41.32B | 1.32% | 0.072 |

| AVGO | Broadcom Inc | S&P 500 | Technology | 1401.34B | -6.12% | 0.072 |

| EL | Estee Lauder Cos., Inc | S&P 500 | Consumer Defensive | 32.13B | -13.70% | 0.065 |

| RCL | Royal Caribbean Group | S&P 500 | Consumer Cyclical | 95.53B | -1.19% | 0.065 |

| GEV | GE Vernova Inc | S&P 500 | Industrials | 169.44B | -8.10% | 0.057 |

| ALGM | Allegro Microsystems Inc | S&P 400 | Technology | 5.85B | -17.84% | 0.054 |

| IESC | IES Holdings Inc | Barrons 400 | Industrials | 7.06B | -4.09% | 0.053 |

| FIX | Comfort Systems USA, Inc | S&P 400 | Industrials | 24.85B | -3.95% | 0.052 |

| LITE | Lumentum Holdings Inc | S&P 400 | Technology | 8.74B | -3.82% | 0.051 |

| AMD | Advanced Micro Devices Inc | S&P 500 | Technology | 269.78B | -10.94% | 0.046 |

| FN | Fabrinet | S&P 400 | Technology | 11.78B | -7.57% | 0.041 |

| AGX | Argan, Inc | Barrons 400 | Industrials | 3.13B | -9.65% | 0.039 |

| STRL | Sterling Infrastructure Inc | Barrons 400 | Industrials | 8.91B | -8.98% | 0.038 |

| ORCL | Oracle Corp | S&P 500 | Technology | 659.01B | -10.06% | 0.036 |

| JBL | Jabil Inc | S&P 500 | Technology | 22.26B | -10.92% | 0.032 |

| VST | Vistra Corp | S&P 500 | Utilities | 66.09B | -10.05% | 0.025 |

| VRT | Vertiv Holdings Co | Barrons 400 | Industrials | 49.21B | -17.30% | 0.024 |

| PLTR | Palantir Technologies Inc | S&P 500 | Technology | 381.83B | -15.29% | 0.021 |

| cash | Cash | Cash | Cash | – | - | 0.0 |

As always, more trades next week!