This week, we executed 2 new trades, including 2 buy(s) and 0 sell(s).

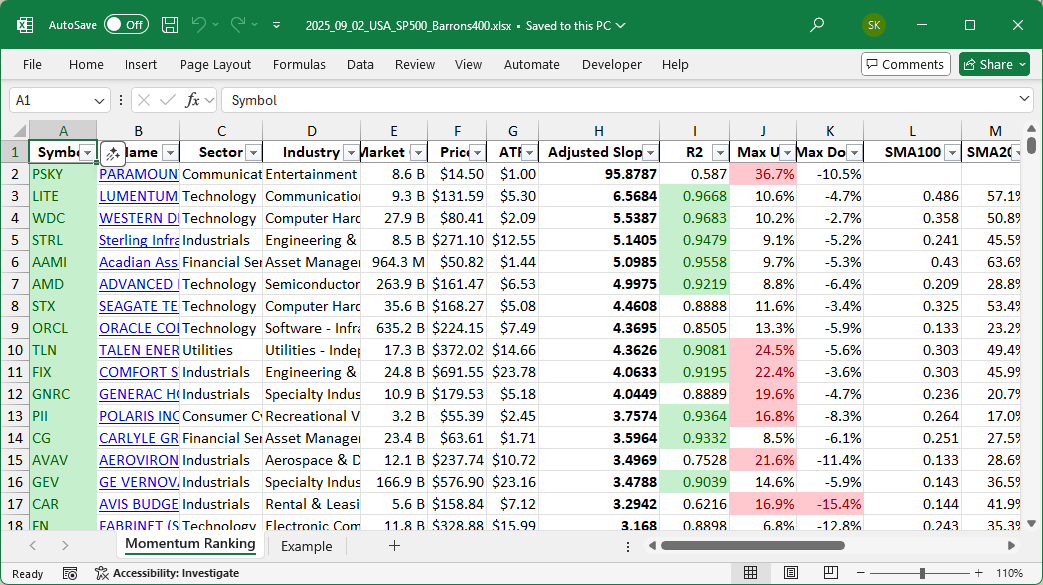

Get ahead of the game with our weekly Momentum Ranking report! Click here to see the top stocks for week 36.

Weekly Portfolio Update: Staying on the Momentum Track

In an eventful week for the markets, characterized by the S&P 500’s sustained position above its 200-day moving average for 78 days, we continue to navigate based on the momentum strategy from Stocks On The Move by Andreas Clenow. With a low cash position of approximately 1.99%, we’re nearly fully invested, reflecting our confidence in the current market dynamics.

Trade Actions Overview:

This week, we strategically opened new positions in AAMI and Western Digital Corp (WDC). AAMI, rooted in the robust healthcare sector, promises innovative solutions driving its momentum. WDC, a key player in the technology domain, stands out with its compelling data storage solutions, fitting well within our momentum-focused criteria.

While no stocks were removed from our portfolio, today, we trimmed some holdings and used the proceeds to open these 2 new positions. We reduced our stakes in ALGM, AMD, AVGO, GEV, IESC, and NVDA to better balance our portfolio. Continue monitoring these dynamics with us.

Summary of Current Portfolio Focus:

Technology remains our top-performing sector, often serving as a growth engine in a diversified portfolio due to its resilience and innovation. Our current top holdings include FLEX, WDC, and CCL, illustrating a focus on momentum leaders across various sectors. On the performance front, our standout performer is FN with an impressive +19.58% gain, while ORCL lagged slightly with a -3.02% decline.

As always, we invite you to share your thoughts and engage with us in the comments. Your insights are valuable as we collectively navigate the investing landscape.

This week’s transactions:

-

Rebalanced / added:

- No positions were added to in this week!

-

Rebalanced / reduced:

Index Distribution:

Currently, most stocks of the portfolio are coming from the S&P 500:

Current portfolio allocation:

The biggest share of our portfolio is currently allocated to the Technology sector.

Weekly sector distribution:

Current portfolio (@finviz):

| Symbol | Name | Index | Sector | MC | Dist to 52w High | pct |

|---|---|---|---|---|---|---|

| FLEX | Flex Ltd | S&P 400 | Technology | 20.09B | -2.36% | 0.076 |

| WDC | Western Digital Corp | S&P 500 | Technology | 28.36B | -0.69% | 0.074 |

| CCL | Carnival Corp | S&P 500 | Consumer Cyclical | 40.36B | -5.23% | 0.074 |

| RCL | Royal Caribbean Group | S&P 500 | Consumer Cyclical | 95.93B | -3.64% | 0.068 |

| EL | Estee Lauder Cos., Inc | S&P 500 | Consumer Defensive | 32.70B | -12.16% | 0.067 |

| AVGO | Broadcom Inc | S&P 500 | Technology | 1402.15B | -6.06% | 0.061 |

| LITE | Lumentum Holdings Inc | S&P 400 | Technology | 9.27B | -3.27% | 0.055 |

| FIX | Comfort Systems USA, Inc | S&P 400 | Industrials | 24.65B | -4.72% | 0.053 |

| AAMI | Acadian Asset Management Inc | Barrons 400 | Financial Services | 1.80B | -2.80% | 0.052 |

| FN | Fabrinet | S&P 400 | Technology | 11.94B | -7.14% | 0.044 |

| IESC | IES Holdings Inc | Barrons 400 | Industrials | 6.89B | -6.41% | 0.039 |

| AGX | Argan, Inc | Barrons 400 | Industrials | 3.05B | -11.90% | 0.039 |

| STRL | Sterling Infrastructure Inc | Barrons 400 | Industrials | 8.46B | -13.56% | 0.037 |

| NVDA | NVIDIA Corp | S&P 500 | n/a | 4148.50B | -7.46% | 0.036 |

| ORCL | Oracle Corp | S&P 500 | Technology | 629.38B | -14.11% | 0.034 |

| JBL | Jabil Inc | S&P 500 | Technology | 21.57B | -13.69% | 0.031 |

| ALGM | Allegro Microsystems Inc | S&P 400 | Technology | 5.61B | -21.11% | 0.025 |

| VST | Vistra Corp | S&P 500 | Utilities | 63.06B | -14.17% | 0.025 |

| AMD | Advanced Micro Devices Inc | S&P 500 | Technology | 262.22B | -13.43% | 0.024 |

| VRT | Vertiv Holdings Co | Barrons 400 | Industrials | 47.31B | -20.50% | 0.024 |

| GEV | GE Vernova Inc | S&P 500 | Industrials | 156.68B | -15.02% | 0.023 |

| PLTR | Palantir Technologies Inc | S&P 500 | Technology | 373.21B | -17.20% | 0.021 |

| cash | Cash | Cash | Cash | – | - | 0.02 |

As always, more trades next week!