Our activity in the market this week involved 3 new trades, specifically 0 buy(s) and 3 sell(s).

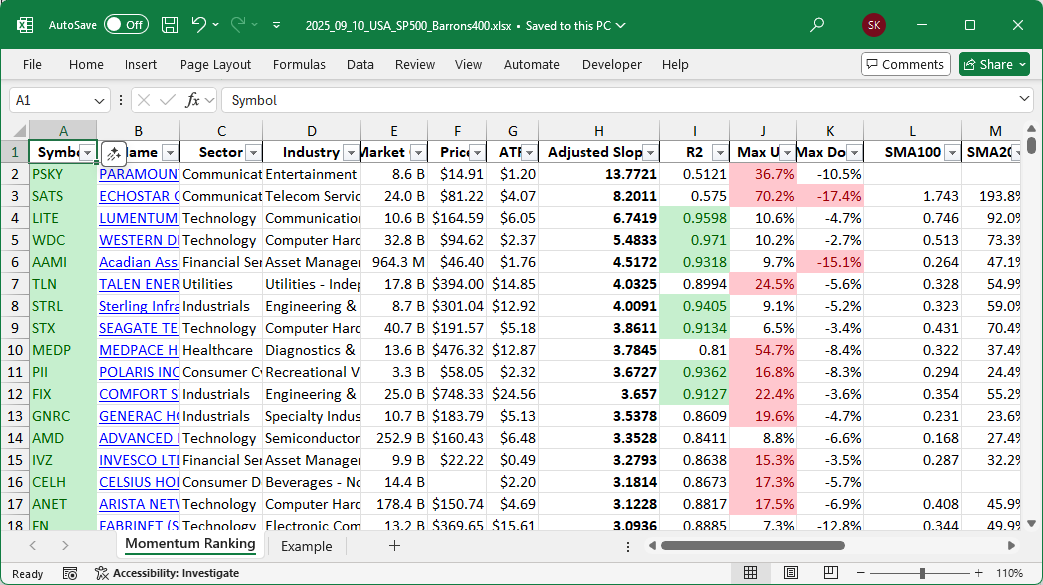

Get ahead of the game with our weekly Momentum Ranking report! Click here to see the top stocks for week 37.

Trade Tuesday on a Wednesday, whew! There were some issues with the Interactive Brokers API, so please excuse the delay. Let’s dive into this week’s market update. With the S&P 500 currently holding above its 200-day moving average for 84 days, the regime filter remains bullish. Our portfolio’s cash share stands at just 1.02%, meaning we are almost fully invested, a testament to the prevailing market confidence.

This week, we made several adjustments to our portfolio. Most notably, we sold AAMI, AGX, and ALGM. These moves reflect our strategy from Andreas Clenow’s Stocks On The Move, where stocks outside the top 10% momentum ranking or those trading below their 100-day moving average must be sold.

We added to our existing positions in GEV, JBL, NVDA, PLTR, VRT, and VST. These additions align with our focus on maintaining a strong momentum profile in our portfolio. Conversely, we trimmed our positions in EL and LITE to keep our allocations balanced.

Technology continues to dominate as our top sector, often regarded for its potential high returns and innovation-driven growth. Our current top holdings include WDC, FLEX, and JBL�each representing our strategic emphasis on momentum. Notably, WDC performed best this week, surging by 17.80%, while RCL underperformed, declining by 4.93%.

We are almost fully invested, reflecting our confidence in the current market climate. Feel free to share your thoughts in the comments below!

This week’s transactions:

-

Sold:

-

Bought:

- No buys in this week!

-

Rebalanced / added:

-

Rebalanced / reduced:

Index Distribution:

Our biggest stock holdings at the moment are in the S&P 500 category.

Current portfolio allocation:

The biggest share of our portfolio is currently allocated to the Technology sector.

Weekly sector distribution:

Current portfolio (@finviz):

| Symbol | Name | Index | Sector | MC | Dist to 52w High | pct |

|---|---|---|---|---|---|---|

| WDC | Western Digital Corp | S&P 500 | Technology | 32.80B | -0.87% | 0.085 |

| FLEX | Flex Ltd | S&P 400 | Technology | 21.65B | 1.47% | 0.078 |

| JBL | Jabil Inc | S&P 500 | Technology | 22.97B | -8.10% | 0.073 |

| NVDA | NVIDIA Corp | S&P 500 | n/a | 4323.94B | -3.55% | 0.072 |

| CCL | Carnival Corp | S&P 500 | Consumer Cyclical | 40.25B | -5.66% | 0.071 |

| AVGO | Broadcom Inc | S&P 500 | Technology | 1711.40B | 2.11% | 0.068 |

| RCL | Royal Caribbean Group | S&P 500 | Consumer Cyclical | 91.66B | -7.93% | 0.063 |

| FIX | Comfort Systems USA, Inc | S&P 400 | Industrials | 26.65B | 3.03% | 0.052 |

| FN | Fabrinet | S&P 400 | Technology | 13.23B | -2.08% | 0.047 |

| VST | Vistra Corp | S&P 500 | Utilities | 71.92B | -2.11% | 0.046 |

| PLTR | Palantir Technologies Inc | S&P 500 | Technology | 397.51B | -11.81% | 0.045 |

| GEV | GE Vernova Inc | S&P 500 | Industrials | 174.85B | -5.17% | 0.044 |

| VRT | Vertiv Holdings Co | Barrons 400 | Industrials | 53.47B | -10.16% | 0.041 |

| IESC | IES Holdings Inc | Barrons 400 | Industrials | 7.61B | 3.31% | 0.04 |

| STRL | Sterling Infrastructure Inc | Barrons 400 | Industrials | 9.19B | -6.16% | 0.037 |

| LITE | Lumentum Holdings Inc | S&P 400 | Technology | 11.50B | 7.80% | 0.036 |

| ORCL | Oracle Corp | S&P 500 | Technology | 936.89B | 27.86% | 0.035 |

| EL | Estee Lauder Cos., Inc | S&P 500 | Consumer Defensive | 31.54B | -15.27% | 0.033 |

| AMD | Advanced Micro Devices Inc | S&P 500 | Technology | 261.46B | -13.68% | 0.023 |

| cash | Cash | Cash | Cash | – | - | 0.01 |

As always, more trades next week!