This week, we carried out 6 new trades - 4 buy(s) and 2 sell(s).

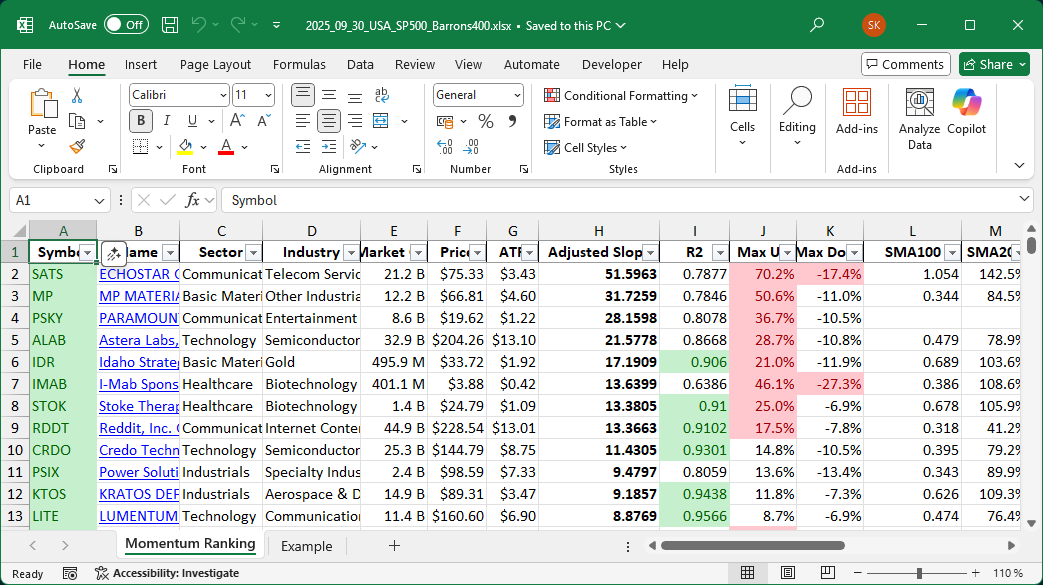

Want to stay on top of the market trends? Our Momentum Ranking report highlights the top stocks of the week, so you don’t have to! Click here to access the latest data for week 40.

Navigating the Momentum Markets: Weekly Portfolio Update

As we step into the beautiful fall and with the third quarter nearing its end, it’s time to take a closer look at our portfolio’s performance this week. Impressively, the S&P 500 has maintained its strength, trading above its 200-day moving average for 98 days, a key signal in our strategy, as outlined in Andreas Clenow’s Stocks On The Move. Our cash share is a mere 1.02%, indicating that we are almost fully invested, aligning well with our momentum-based strategy.

This Week’s Trades:

We’ve made some strategic moves this week. New Buys include Coeur Mining Inc. (CDE), enhancing our stake in the materials sector known for its dividend allure; Kratos Defense & Security Solutions, Inc. (KTOS), representing our interest in aerospace, expected to benefit from rising defense budgets; EchoStar Corporation (SATS) in the communication services space, holding its own in satellite operations; and Willdan Group (WLDN) from the industrial sector, offering a blend of engineering services that are gaining traction.

On the other hand, we bid goodbye to Estée Lauder Companies Inc. (EL) and Royal Caribbean Group (RCL) this week, as they no longer meet our ranking criteria. Furthermore, we reduced our positions in Carnival Corporation (CCL), Global Eagle Entertainment (GEV), and Western Digital Corporation (WDC), making way for more promising opportunities.

Portfolio Highlights:

Our top sector remains Technology, reflecting its robust potential for growth and innovation. It’s a sector that typically drives major breakthroughs in portfolios like ours. Top holdings include Medpace Holdings, Inc. (MEDP), Flex Ltd. (FLEX), and NVIDIA Corporation (NVDA)—each providing unique value propositions across different industries. Western Digital Corporation was the standout performer, gaining a solid 9.48%, while Alithya Group Inc. (ALAB) saw a dip of 18.92%.

Stay tuned as next week we’ll be updating our monthly performance for September. We’d love to hear your thoughts on our approach—feel free to share in the comments below.

This week’s transactions:

Index Distribution:

We’re mainly invested in stocks from the S&P 500 group at the moment.

Current portfolio allocation:

The Technology sector is now the big cheese in our portfolio.

Weekly sector distribution:

Current portfolio (@finviz):

| Symbol | Name | Index | Sector | MC | Dist to 52w High | pct |

|---|---|---|---|---|---|---|

| MEDP | Medpace Holdings Inc | S&P 400 | Healthcare | 14.12B | -0.76% | 0.078 |

| FLEX | Flex Ltd | S&P 400 | Technology | 21.58B | -3.77% | 0.076 |

| NVDA | NVIDIA Corp | S&P 500 | Technology | 4512.27B | 0.62% | 0.073 |

| AMD | Advanced Micro Devices Inc | S&P 500 | Technology | 261.51B | -13.66% | 0.056 |

| FIX | Comfort Systems USA, Inc | S&P 400 | Industrials | 28.52B | -2.02% | 0.056 |

| AVGO | Broadcom Inc | S&P 500 | Technology | 1536.42B | -13.06% | 0.051 |

| WDC | Western Digital Corp | S&P 500 | Technology | 42.12B | 2.78% | 0.049 |

| PLTR | Palantir Technologies Inc | S&P 500 | Technology | 427.78B | -5.09% | 0.047 |

| FN | Fabrinet | S&P 400 | Technology | 12.86B | -9.37% | 0.044 |

| STRL | Sterling Infrastructure Inc | Barrons 400 | Industrials | 10.34B | -9.81% | 0.041 |

| IESC | IES Holdings Inc | Barrons 400 | Industrials | 7.80B | -2.84% | 0.041 |

| CDE | Coeur Mining Inc | Barrons 400 | Basic Materials | 12.15B | -1.38% | 0.04 |

| ORCL | Oracle Corp | S&P 500 | Technology | 793.06B | -19.28% | 0.039 |

| KTOS | Kratos Defense & Security Solutions Inc | S&P 400 | Industrials | 15.25B | 0.77% | 0.037 |

| LITE | Lumentum Holdings Inc | S&P 400 | Technology | 11.28B | -6.96% | 0.037 |

| RDDT | Reddit Inc | Barrons 400 | Communication Services | 43.12B | -18.57% | 0.034 |

| GEV | GE Vernova Inc | S&P 500 | Industrials | 165.60B | -10.18% | 0.031 |

| SATS | EchoStar Corp | S&P 400 | Communication Services | 21.59B | -12.12% | 0.031 |

| CCL | Carnival Corp | S&P 500 | Consumer Cyclical | 37.84B | -11.10% | 0.03 |

| PSKY | Paramount Skydance Corp | S&P 500 | Communication Services | 20.83B | -6.23% | 0.029 |

| WLDN | Willdan Group Inc | Barrons 400 | Industrials | 1.42B | -20.13% | 0.028 |

| PSIX | Power Solutions International Inc | Barrons 400 | Industrials | 2.28B | -18.74% | 0.021 |

| ALAB | Astera Labs Inc | Barrons 400 | Technology | 32.22B | -26.26% | 0.021 |

| cash | Cash | Cash | Cash | – | - | 0.01 |

As always, more trades next week!