This week was quiet on the trading front - no new buys or sells.

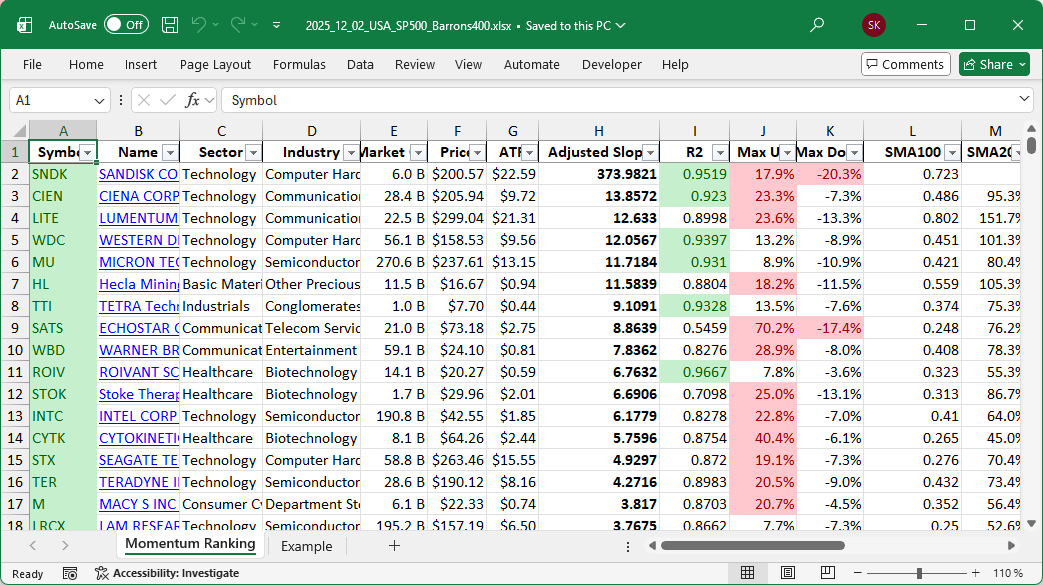

Click here for the Momentum Ranking of week 49.

Weekly Portfolio Update: Trading Strategy Insights

Welcome to our latest portfolio update, where we offer a friendly glance into this week’s market dynamics and trading activities. It’s been an engaging enviroment for traders as the S&P 500 has remained above its 200-day moving average for 142 days�a positive sign for our momentum-based strategy inspired by Andreas Clenow’s Stocks On The Move. With a cash share of slightly below 2%, we’re almost fully committed to our investment strategy, ensuring that we can capitalize on existing opportunities in this bullish regime.

This week, our trading activity included some key adjustments rather than any outright buys or sells. We added to our existing positions in ROIV and SATS, signaling our confidence in these stocks’ momentum. Conversely, we trimmed our positions in IDCC and STRL to maintain our alignment with their current slope rankings and market performance. These careful rebalances are part of our strategy to sustain a robust and responsive portfolio.

The Technology sector remains our top focus, playing a critical role in driving growth and innovation within our portfolio. This week, our top holdings include ROIV, WBD, and TER, highlighting our diversified sector approach. Notably, LITE was our best performer with an impressive gain of over 36%, while ROIV was the least performing, dipping by a small margin that doesn’t raise concerns.

Reflecting on our financial journey, the Trade Tuesday portfolio faced a minor setback in November, losing 1.5%, but we’re still celebrating a 28% increase for the year. These results underscore our commitment to a disciplined and methodical investment approach.

As always, we welcome your thoughts and insights in the comments below. Share your perspectives on the current market trends or any questions you might have. Your engagement enriches our community and trading strategies.

This week’s transactions:

-

Sold:

- No sells in this week!

-

Bought:

- No buys in this week!

-

Rebalanced / added:

-

Rebalanced / reduced:

Index Distribution:

Most of our holdings are from the S&P 500 index right now.

Current portfolio allocation:

Our portfolio is heavily invested in the Technology sector right now.

Weekly sector distribution:

Current portfolio (@finviz):

| Symbol | Name | Index | Sector | MC | Dist to 52w High | pct |

|---|---|---|---|---|---|---|

| ROIV | Roivant Sciences Ltd | S&P 400 | Healthcare | 13.99B | -5.78% | 0.062 |

| WBD | Warner Bros. Discovery Inc | S&P 500 | Communication Services | 61.24B | 2.12% | 0.062 |

| TER | Teradyne, Inc | S&P 500 | Technology | 29.97B | -0.10% | 0.058 |

| AVGO | Broadcom Inc | S&P 500 | Technology | 1800.73B | -5.38% | 0.056 |

| FN | Fabrinet | S&P 400 | Technology | 15.85B | -11.16% | 0.051 |

| CIEN | CIENA Corp | S&P 400 | Technology | 28.56B | -5.47% | 0.049 |

| SATS | EchoStar Corp | S&P 400 | Communication Services | 21.26B | -13.51% | 0.047 |

| FIX | Comfort Systems USA, Inc | S&P 400 | Industrials | 33.16B | -7.85% | 0.047 |

| INTC | Intel Corp | S&P 500 | Technology | 206.94B | 2.13% | 0.045 |

| WDC | Western Digital Corp | S&P 500 | Technology | 55.58B | -8.90% | 0.04 |

| IESC | IES Holdings Inc | Barrons 400 | Industrials | 8.26B | -6.08% | 0.039 |

| MU | Micron Technology Inc | S&P 500 | Technology | 268.72B | -8.36% | 0.035 |

| TTI | Tetra Technologies, Inc | Barrons 400 | Industrials | 1.05B | -5.65% | 0.031 |

| POWL | Powell Industries, Inc | Barrons 400 | Industrials | 3.93B | -21.28% | 0.031 |

| HL | Hecla Mining Co | Barrons 400 | Basic Materials | 11.60B | -0.49% | 0.031 |

| LITE | Lumentum Holdings Inc | S&P 400 | Technology | 21.74B | -5.79% | 0.031 |

| APP | Applovin Corp | S&P 500 | Communication Services | 220.89B | -12.34% | 0.03 |

| MEDP | Medpace Holdings Inc | S&P 400 | Healthcare | 16.60B | -5.93% | 0.029 |

| AMD | Advanced Micro Devices Inc | S&P 500 | Technology | 351.24B | -19.22% | 0.029 |

| STOK | Stoke Therapeutics Inc | Barrons 400 | Healthcare | 1.69B | -23.32% | 0.026 |

| STX | Seagate Technology Holdings Plc | S&P 500 | Technology | 57.21B | -10.06% | 0.026 |

| CYTK | Cytokinetics Inc | S&P 400 | Healthcare | 7.72B | -8.98% | 0.024 |

| STRL | Sterling Infrastructure Inc | S&P 400 | Industrials | 10.10B | -21.55% | 0.021 |

| SBH | Sally Beauty Holdings Inc | Barrons 400 | Consumer Cyclical | 1.56B | -8.30% | 0.021 |

| FLEX | Flex Ltd | S&P 400 | Technology | 21.27B | -14.15% | 0.02 |

| cash | Cash | Cash | Cash | – | - | 0.02 |

| SSRM | SSR Mining Inc | Barrons 400 | Basic Materials | 4.42B | -16.25% | 0.019 |

| IDCC | Interdigital Inc | Barrons 400 | Technology | 8.87B | -16.51% | 0.017 |

As always, more trades next week!