In this week, there were 3 new trades: 1 buy(s) and 2 sell(s).

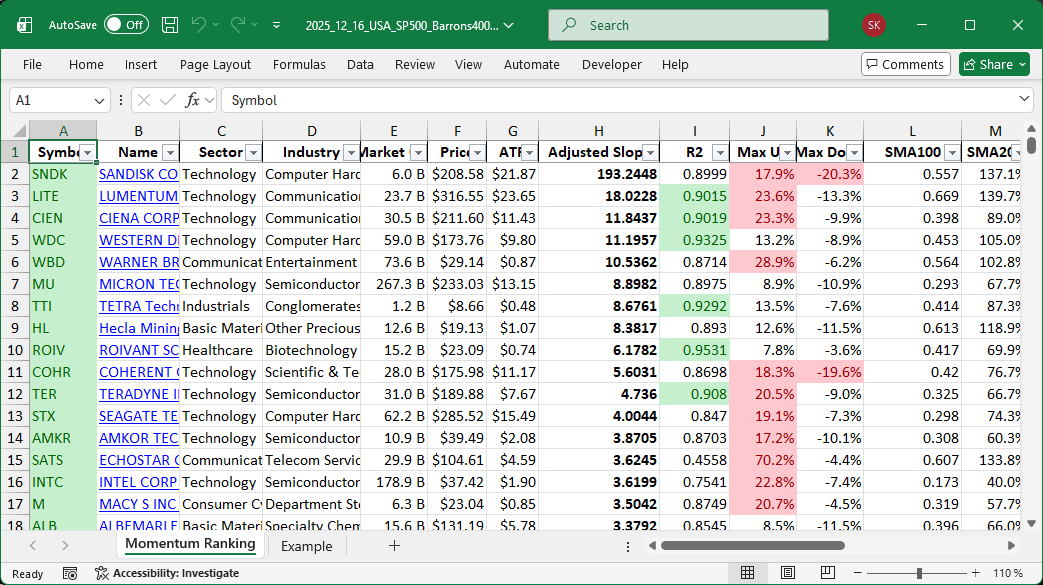

Discover the top-performing stocks of the week with our Momentum Ranking! Click here to access the latest data for week 51.

As 2025 gradually draws to a close, with just two more updates to go this year, we’ve had another interesting week in the market. The S&P 500 has been trading above its 200-day moving average for 152 days straight, suggesting a postive market regime. With our current cash share at just -0.73%, we are nearly fully invested.

Trading Activity Summary:

This week, we welcomed a new addition to our portfolio: ALB, a leading player in the materials sector focusing on sustainable energy solutions. This aligns with our momentum strategy, as detailed in Andreas Clenow’s “Stocks On The Move”, which ranks stocks based on their annualized adjusted slope.

We also bid farewell to SSRM and STRL. Both stocks have fallen out of the top momentum rankings, as consistent with our disciplined approach, which prompts sales if a stock no longer ranks among the top 10% on our list or dips below its 100-day moving average.

Portfolio Highlights:

Technology continues to dominate as our top-performing sector, playing its typical role in a growth-oriented portfolio. The sector’s innovative edge often provides opportunities for significant returns. Our current top holdings include ROIV, SATS, and TER, each from various sectors. In terms of performance, SATS emerged as our star performer with a 26.74% gain, while AVGO was the least impressive, declining by 12.92%.

Engaging with our readers is important, and we’d love to hear your thoughts. Feel free to share your insights and questions in the comments below. Let’s connect as we wrap up this thrilling year in investment and trading!

This week’s transactions:

-

Rebalanced / added:

- No positions were added to in this week!

-

Rebalanced / reduced:

- No positions were reduced in this week!

Index Distribution:

The majority of our portfolio is currently made up of stocks from the S&P 400 sector.

Current portfolio allocation:

Currently, the Technology sector is the main player in our portfolio.

Weekly sector distribution:

Current portfolio (@finviz):

| Symbol | Name | Index | Sector | MC | Dist to 52w High | pct |

|---|---|---|---|---|---|---|

| ROIV | Roivant Sciences Ltd | S&P 400 | Healthcare | 16.10B | 2.59% | 0.064 |

| SATS | EchoStar Corp | S&P 400 | Communication Services | 29.96B | -6.23% | 0.064 |

| TER | Teradyne, Inc | S&P 500 | Technology | 29.72B | -7.42% | 0.06 |

| FN | Fabrinet | S&P 400 | Technology | 15.96B | -16.14% | 0.051 |

| CIEN | CIENA Corp | S&P 400 | Technology | 29.54B | -15.44% | 0.05 |

| WBD | Warner Bros. Discovery Inc | S&P 500 | Communication Services | 72.31B | -2.75% | 0.05 |

| CYTK | Cytokinetics Inc | S&P 400 | Healthcare | 7.51B | -11.44% | 0.05 |

| AVGO | Broadcom Inc | S&P 500 | Technology | 1622.27B | -17.14% | 0.047 |

| ALB | Albemarle Corp | S&P 500 | Basic Materials | 15.38B | -3.96% | 0.045 |

| FIX | Comfort Systems USA, Inc | S&P 400 | Industrials | 34.07B | -6.83% | 0.045 |

| IDCC | Interdigital Inc | Barrons 400 | Technology | 8.88B | -16.36% | 0.043 |

| IESC | IES Holdings Inc | Barrons 400 | Industrials | 8.85B | -7.60% | 0.042 |

| INTC | Intel Corp | S&P 500 | Technology | 177.56B | -15.44% | 0.04 |

| WDC | Western Digital Corp | S&P 500 | Technology | 59.69B | -7.52% | 0.04 |

| TTI | Tetra Technologies, Inc | Barrons 400 | Industrials | 1.17B | -7.24% | 0.034 |

| MU | Micron Technology Inc | S&P 500 | Technology | 260.78B | -12.47% | 0.033 |

| HL | Hecla Mining Co | Barrons 400 | Basic Materials | 12.88B | -4.78% | 0.032 |

| APP | Applovin Corp | S&P 500 | Communication Services | 226.71B | -10.03% | 0.031 |

| LITE | Lumentum Holdings Inc | S&P 400 | Technology | 22.31B | -16.43% | 0.031 |

| POWL | Powell Industries, Inc | Barrons 400 | Industrials | 3.97B | -20.42% | 0.03 |

| STOK | Stoke Therapeutics Inc | Barrons 400 | Healthcare | 1.89B | -14.67% | 0.027 |

| STX | Seagate Technology Holdings Plc | S&P 500 | Technology | 61.19B | -7.25% | 0.026 |

| MEDP | Medpace Holdings Inc | S&P 400 | Healthcare | 15.57B | -11.75% | 0.026 |

| AMD | Advanced Micro Devices Inc | S&P 500 | Technology | 339.56B | -21.91% | 0.026 |

| FLEX | Flex Ltd | S&P 400 | Technology | 24.03B | -10.01% | 0.023 |

| cash | Cash | Cash | Cash | – | - | -0.007 |

As always, more trades next week!