The week’s activity resulted in 3 new trades — 1 buy and 2 sells.

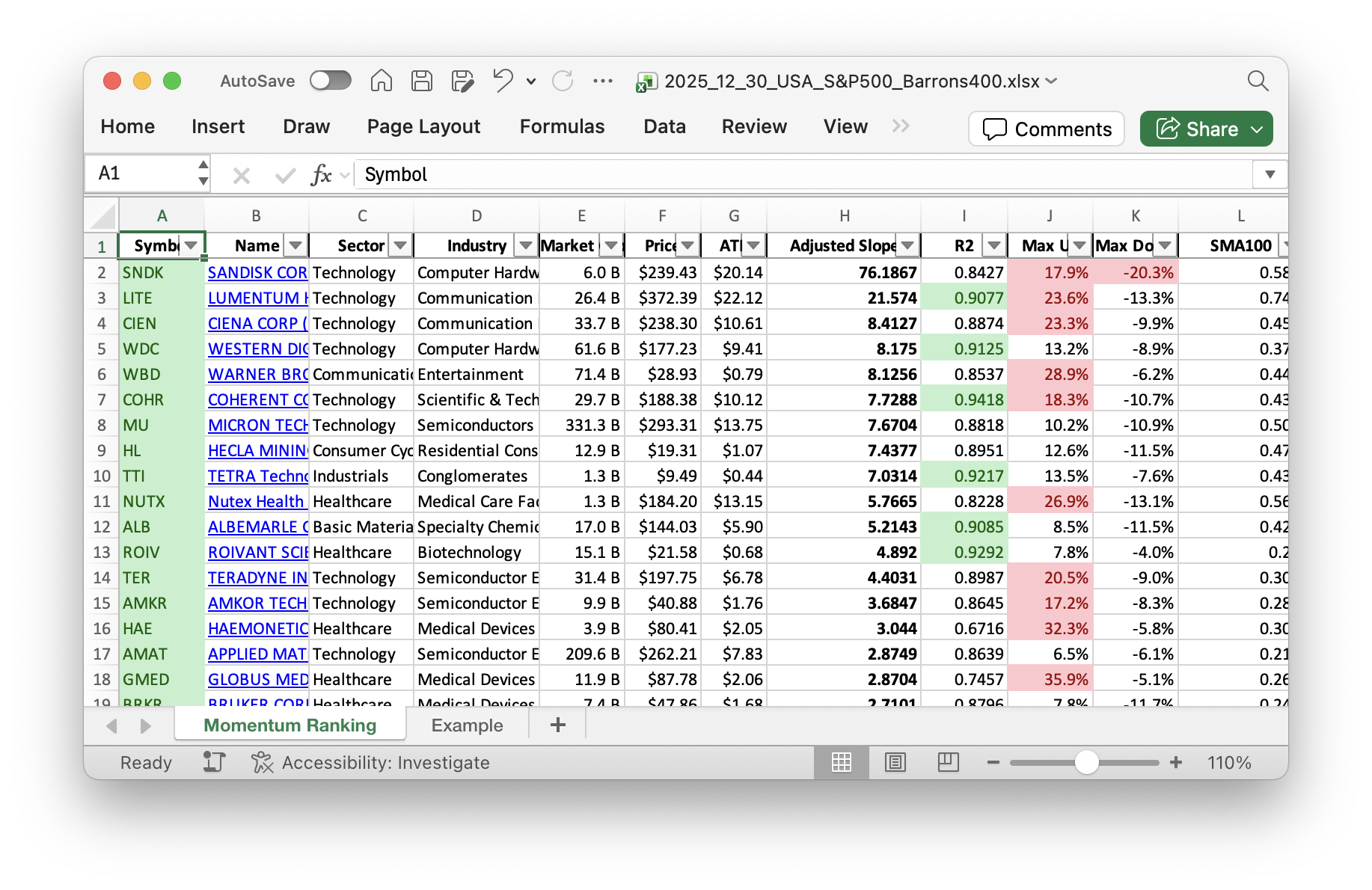

Whether you’re an investor or just interested in the stock market, our weekly Momentum Ranking report based on Andreas Clenow’s book Stocks on the Move is a must-read! Click here to access the latest data for week 01 and stay up-to-date on the top performers.

Weekly Portfolio Update: A Calm in the Markets

This week in the markket world, we’ve observed a stable tone, marked by the fact that the S&P 500 has been above its 200-day moving average for 161 days. This ongoing trend enables us to comfortably explore new positions within our portfolio. With only 0.9% cash in reserve, we are nearly fully invested, reflecting our confidence in the current market environment.

This Week’s Trades:

In our latest updates, we’ve made a fresh purchase by adding Applied Materials Inc. (AMAT) to our portfolio, a key player in the technology sector known for its cutting-edge innovations in materials engineering and semiconductor production. On the other hand, we have decided to sell our positions in Flex Ltd. (FLEX) and IES Holdings Inc. (IESC) to make room for higher-ranked opportunities. This aligns with our momentum-based strategy detailed in Andreas Clenow’s “Stocks On The Move,” where stocks are evaluated based on their adjusted slope.

Moreover, we have adjusted some of our existing holdings by adding to our stake in Advanced Micro Devices, Inc. (AMD), enhancing our exposure to the thriving semiconductor industry. Simultaneously, we have reduced our position in Cytokinetics, Inc. (CYTK), as part of our continual rebalancing process to optimize performance.

Portfolio Overview:

The Technology sector remains at the forefront of our portfolio, typically recognized for its growth and innovation potential. Esteemed companies such as AMD and AMAT showcase the sector’s influence. Our top holdings include MEDP (Medpace Holdings, Inc.), SATS (EchoStar Corporation), and AMAT, demonstrating the diversity and strength within our investments.

This week, the top-performing stock was Micron Technology Inc. (MU), boasting an impressive gain of +18.48%, while Seagate Technology (STX) recorded a lighter performance, declining by -3.41%. We’re proud to say that our strategy keeps us aligned with high momentum securities and well-prepared for dynamic shifts in market conditions.

As the year comes to a close, this marks our final update for 2025. In our next issue, we’ll reflect on the year’s journey and anticipate what’s ahead. Feel free to share your thoughts and perspectives in the comments section below. Your insights are always valuable to us!

This week’s transactions:

Index Distribution:

Our portfolio is currently dominated by stocks from the S&P 500 index.

Current portfolio allocation:

Right now, the Technology sector is where most of our money is at.

Weekly sector distribution:

Current portfolio (@finviz):

| Symbol | Name | Index | Sector | MC | Dist to 52w High | pct |

|---|---|---|---|---|---|---|

| MEDP | Medpace Holdings Inc | S&P 400 | Healthcare | 16.03B | -9.11% | 0.068 |

| SATS | EchoStar Corp | S&P 400 | Communication Services | 31.60B | -1.44% | 0.065 |

| AMAT | Applied Materials Inc | S&P 500 | Technology | 207.30B | -5.31% | 0.063 |

| ROIV | Roivant Sciences Ltd | S&P 400 | Healthcare | 14.96B | -8.37% | 0.062 |

| TER | Teradyne, Inc | S&P 500 | Technology | 30.88B | -3.83% | 0.059 |

| CIEN | CIENA Corp | S&P 400 | Technology | 33.62B | -3.75% | 0.054 |

| FN | Fabrinet | S&P 400 | Technology | 16.66B | -12.46% | 0.049 |

| ALB | Albemarle Corp | S&P 500 | Basic Materials | 16.85B | -5.84% | 0.048 |

| WBD | Warner Bros. Discovery Inc | S&P 500 | Communication Services | 71.71B | -3.55% | 0.047 |

| AMD | Advanced Micro Devices Inc | S&P 500 | Technology | 350.26B | -19.45% | 0.045 |

| FIX | Comfort Systems USA, Inc | S&P 500 | Consumer Cyclical | 33.67B | -7.93% | 0.043 |

| WDC | Western Digital Corp | S&P 500 | Technology | 60.81B | -5.79% | 0.04 |

| MU | Micron Technology Inc | S&P 500 | Technology | 332.18B | 0.22% | 0.04 |

| INTC | Intel Corp | S&P 500 | Technology | 180.50B | -14.04% | 0.038 |

| TTI | Tetra Technologies, Inc | Barrons 400 | Industrials | 1.27B | -0.13% | 0.035 |

| COHR | Coherent Corp | S&P 400 | Technology | 29.72B | -5.55% | 0.034 |

| LITE | Lumentum Holdings Inc | S&P 400 | Technology | 26.70B | -6.22% | 0.033 |

| HL | Hecla Mining Co | S&P 400 | Consumer Cyclical | 13.19B | -7.13% | 0.032 |

| APP | Applovin Corp | S&P 500 | Communication Services | 235.67B | -6.47% | 0.031 |

| POWL | Powell Industries, Inc | Barrons 400 | Industrials | 4.04B | -19.13% | 0.03 |

| STOK | Stoke Therapeutics Inc | Barrons 400 | Healthcare | 1.81B | -18.11% | 0.026 |

| STX | Seagate Technology Holdings Plc | S&P 500 | Technology | 60.21B | -8.74% | 0.025 |

| CYTK | Cytokinetics Inc | S&P 400 | Healthcare | 7.45B | -14.13% | 0.023 |

| cash | Cash | Cash | Cash | – | - | 0.009 |

As always, more trades next week!