During the past week, we made 5 new trades — 1 buy and 4 sells.

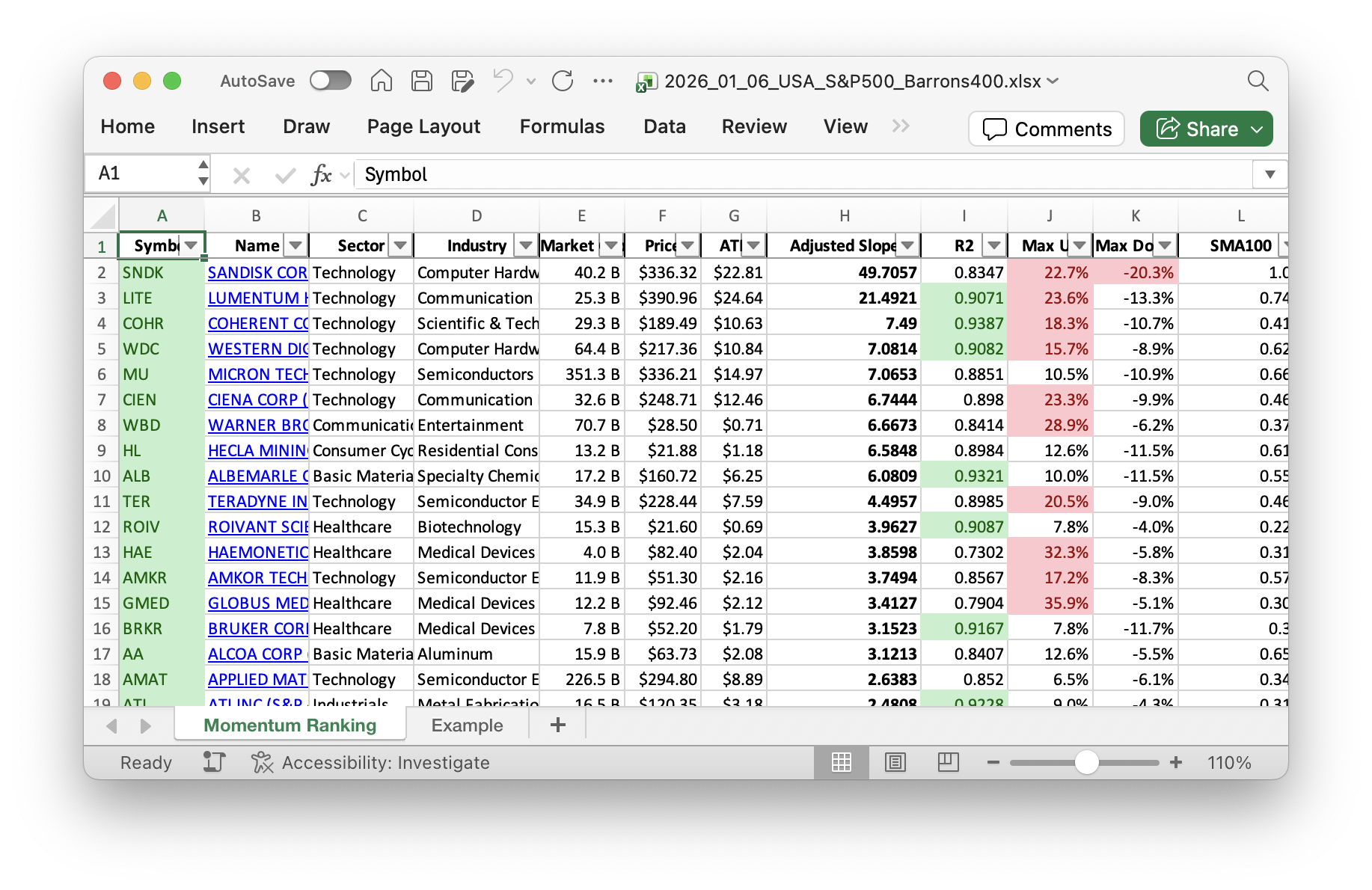

Click here for the Momentum Ranking of week 02.

Welcome to the New Year! As we step into 2026, our portfolio is navigating an intriguing market enviroment with the S&P 500 holding steady above its 200-day moving average for 165 days now. This keeps us in a favorable position to look for new opportunities while staying almost fully invested, given our low cash reserve of 0.8%. Today marks a significant shift as we sold off our last companies from the Barrons 400 index, including STOK, TTI, and POWL, having decided not to consider this index further.

This week, we initiated a position in Haemonetics (HAE), a key player in the healthcare sector. HAE specializes in blood management solutions, aligning with our strategy of investing in top-ranked sectors. On sales, in addition to STOK, TTI, and POWL, we also parted ways with AppLovin (APP) as we continue refining our portfolio to match our investment criteria. Besides this, we added to our existing positions in Cytokinetics (CYTK) and Warner Bros. Discovery (WBD), reflecting our belief in their growth potential.

Technology continues to be the shining star in our portfolio, acting as a powerhouse driving returns and innovation. Within this sector, companies like Applied Materials (AMAT) and Warner Bros. Discovery (WBD) demonstrate robust performance. Our top holdings are currently Warner Bros. Discovery (WBD), Medpace (MEDP), and Applied Materials (AMAT), showcasing a diverse mix of sectors. Notably, our best performer this week is Teradyne (TER), with a solid gain of over 10.56%, while Lumentum Holdings (LITE) faced some challenges, declining by about 9.82%. We’re keen to see how these dynamics play out as the year unfolds. Feel free to share your insights and thoughts in the comments below.

This week’s transactions:

Index Distribution:

We have a lot of stocks from the S&P 500 index in our portfolio at the moment.

Current portfolio allocation:

Our portfolio is currently dominated by the Technology sector.

Weekly sector distribution:

Current portfolio (@finviz):

| Symbol | Name | Index | Sector | MC | Dist to 52w High | pct |

|---|---|---|---|---|---|---|

| WBD | Warner Bros. Discovery Inc | S&P 500 | Communication Services | 70.70B | -4.92% | 0.084 |

| MEDP | Medpace Holdings Inc | S&P 400 | Healthcare | 17.00B | -3.65% | 0.069 |

| AMAT | Applied Materials Inc | S&P 500 | Technology | 233.13B | 2.18% | 0.067 |

| SATS | EchoStar Corp | S&P 400 | Communication Services | 33.40B | 2.26% | 0.065 |

| TER | Teradyne, Inc | S&P 500 | Technology | 35.62B | 2.46% | 0.064 |

| HAE | Haemonetics Corp | S&P 400 | Healthcare | 3.87B | -5.40% | 0.06 |

| ROIV | Roivant Sciences Ltd | S&P 400 | Healthcare | 15.06B | -7.77% | 0.059 |

| CIEN | CIENA Corp | S&P 400 | Technology | 35.17B | -1.14% | 0.051 |

| ALB | Albemarle Corp | S&P 500 | Basic Materials | 18.86B | 5.37% | 0.047 |

| FN | Fabrinet | S&P 400 | Technology | 16.87B | -11.38% | 0.047 |

| CYTK | Cytokinetics Inc | S&P 400 | Healthcare | 7.77B | -10.50% | 0.046 |

| FIX | Comfort Systems USA, Inc | S&P 500 | Consumer Cyclical | 36.01B | -2.80% | 0.045 |

| AMD | Advanced Micro Devices Inc | S&P 500 | Technology | 346.41B | -20.33% | 0.045 |

| WDC | Western Digital Corp | S&P 500 | Technology | 74.09B | 10.63% | 0.041 |

| MU | Micron Technology Inc | S&P 500 | Technology | 378.72B | 3.37% | 0.041 |

| INTC | Intel Corp | S&P 500 | Technology | 189.87B | -9.58% | 0.04 |

| COHR | Coherent Corp | S&P 400 | Technology | 30.13B | -4.23% | 0.033 |

| HL | Hecla Mining Co | S&P 400 | Consumer Cyclical | 14.66B | 3.21% | 0.032 |

| LITE | Lumentum Holdings Inc | S&P 400 | Technology | 27.71B | -2.69% | 0.031 |

| STX | Seagate Technology Holdings Plc | S&P 500 | Technology | 69.61B | 5.51% | 0.025 |

| cash | Cash | Cash | Cash | – | - | 0.008 |

As always, more trades next week!