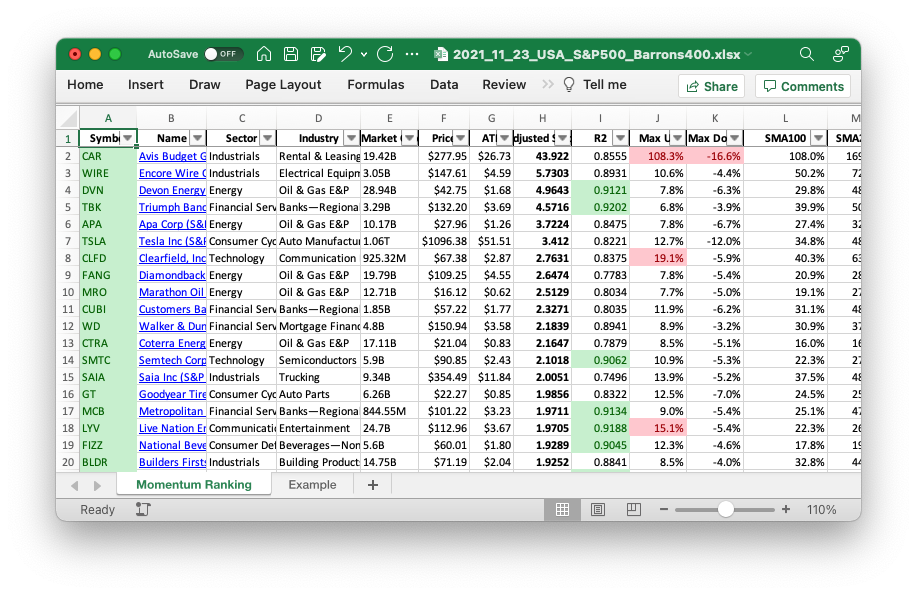

Click here for the Momentum Ranking of week 47.

This week’s transactions:

-

Sold:

- CDAY (price below 100 day MA)

- PAYC (no longer in top 20%)

-

Bought:

- CUBI (Customers Bancorp, Inc. (Barrons 400))

- WD (Walker & Dunlop, Inc. (Barrons 400))

Index Distribution:

The S&P 500, S&P 400 and Barron’s are almost equally distributed at the moment:

Current portfolio allocation:

Tech and Industrials account for half of the portfolio:

Weekly sector distribution:

Current portfolio (@finviz):

| Symbol | Name | Index | Sector | MC | Dist to 52w High | pct |

|---|---|---|---|---|---|---|

| AON | Aon plc | S&P 500 | Financial Services | 65.23B | -0.085 | 0.049 |

| TNET | TriNet Group, Inc. | Barrons 400 | Industrials | 7.01B | -0.03 | 0.048 |

| NSP | Insperity, Inc. | S&P 400 | Industrials | 4.69B | -0.068 | 0.044 |

| WD | Walker & Dunlop, Inc. | Barrons 400 | Financial Services | 4.94B | -0.019 | 0.042 |

| TTEK | Tetra Tech, Inc. | S&P 400 | Industrials | 10.11B | -0.023 | 0.042 |

| SMTC | Semtech Corporation | S&P 400 | Technology | 5.77B | -0.046 | 0.041 |

| IT | Gartner, Inc. | S&P 500 | Technology | 26.59B | -0.128 | 0.038 |

| MPWR | Monolithic Power Systems, Inc. | S&P 500 | Technology | 25.31B | -0.038 | 0.035 |

| TBK | Triumph Bancorp, Inc. | Barrons 400 | Financial Services | 3.31B | -0.046 | 0.035 |

| MATX | Matson, Inc. | Barrons 400 | Industrials | 3.72B | -0.063 | 0.034 |

| INVA | Innoviva, Inc. | Barrons 400 | Healthcare | 1.18B | -0.103 | 0.034 |

| DXCM | DexCom, Inc. | S&P 500 | Healthcare | 58.37B | -0.063 | 0.034 |

| ALB | Albemarle Corporation | S&P 500 | Basic Materials | 31.86B | -0.026 | 0.034 |

| cash | Cash | Cash | Cash | – | 0.0 | 0.033 |

| SYNA | Synaptics Incorporated | S&P 400 | Technology | 10.76B | -0.032 | 0.032 |

| CUBI | Customers Bancorp, Inc. | Barrons 400 | Financial Services | 1.87B | -0.067 | 0.032 |

| WIRE | Encore Wire Corporation | Barrons 400 | Technology | 3.02B | -0.028 | 0.031 |

| MCB | Metropolitan Bank Holding Corp. | Barrons 400 | Financial Services | 1.08B | -0.057 | 0.03 |

| BLDR | Builders FirstSource, Inc. | S&P 400 | Industrials | 13.72B | -0.021 | 0.029 |

| DKS | DICK’S Sporting Goods, Inc. | S&P 400 | Consumer Cyclical | 11.18B | -0.048 | 0.029 |

| GXO | GXO Logistics, Inc. | S&P 400 | Industrials | 11.19B | -0.027 | 0.028 |

| TNDM | Tandem Diabetes Care, Inc. | S&P 400 | Healthcare | 8.26B | -0.076 | 0.026 |

| CTRA | Coterra Energy Inc. | S&P 500 | Energy | 17.18B | -0.113 | 0.026 |

| CLFD | Clearfield, Inc. | Barrons 400 | Technology | 897.4M | -0.07 | 0.023 |

| NVDA | NVIDIA Corporation | S&P 500 | Technology | 782.84B | -0.078 | 0.023 |

| DVN | Devon Energy Corporation | S&P 500 | Energy | 28.96B | -0.081 | 0.021 |

| MRO | Marathon Oil Corporation | S&P 500 | Energy | 12.6B | -0.11 | 0.021 |

| NOW | ServiceNow, Inc. | S&P 500 | Technology | 127.19B | -0.072 | 0.021 |

| FANG | Diamondback Energy, Inc. | S&P 500 | Energy | 19.89B | -0.104 | 0.018 |

| FTNT | Fortinet, Inc. | S&P 500 | Technology | 53B | -0.069 | 0.018 |

| TSLA | Tesla, Inc. | S&P 500 | Consumer Cyclical | 1.13T | -0.07 | 0.018 |

| APA | APA Corporation | S&P 500 | Energy | 10.07B | -0.148 | 0.018 |

| PCTY | Paylocity Holding Corporation | S&P 400 | Technology | 14.2B | -0.157 | 0.015 |

As always, more trades next week!