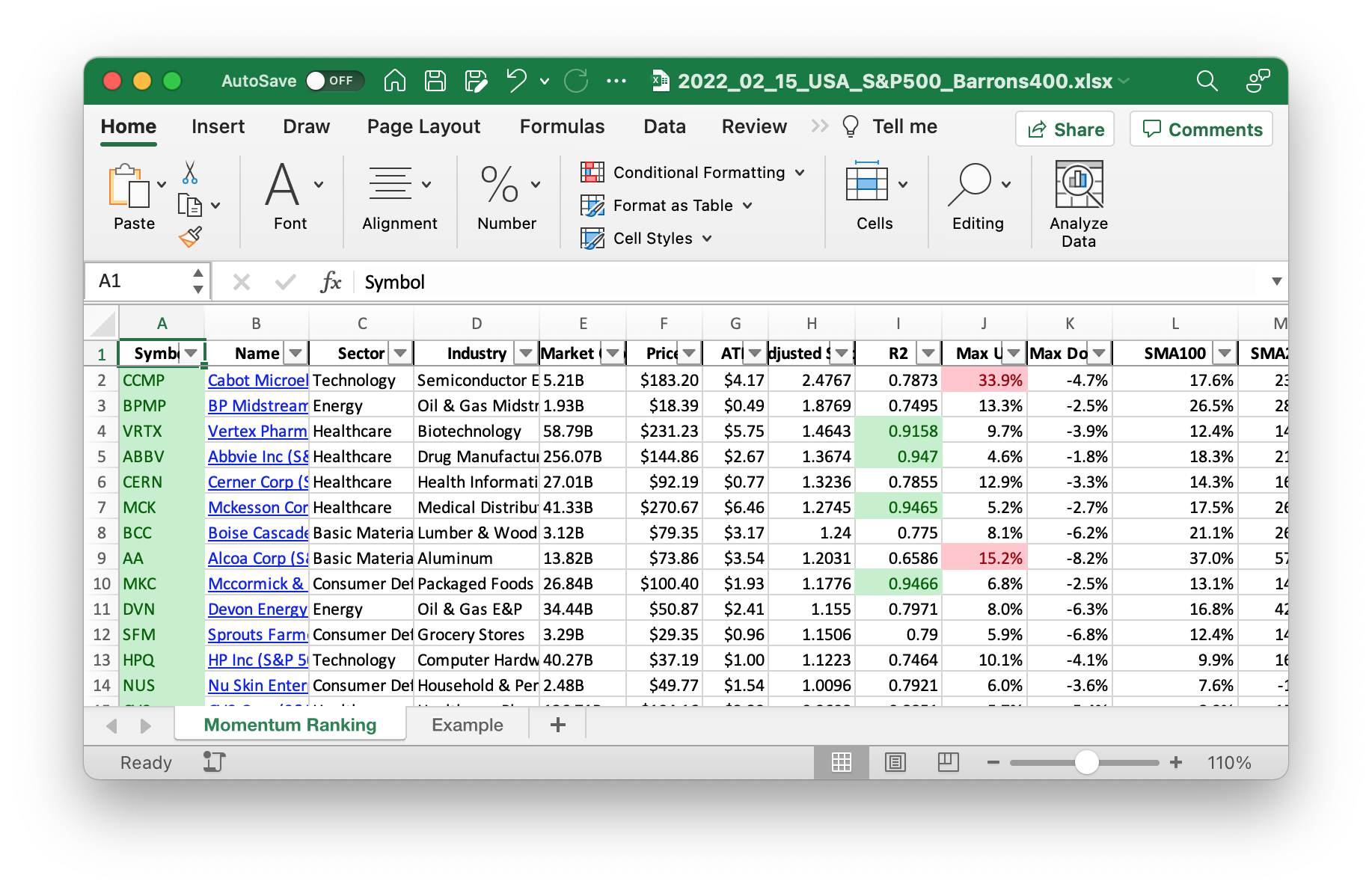

Click here for the Momentum Ranking of week 07.

This week’s transactions:

-

Sold:

- PFE (price below 100 day moving average)

-

Bought:

- AA (Alcoa Corp (S&P 400))

- CVX (Chevron Corp (S&P 500))

Index Distribution:

The S&P 500 still has the highest weight in the portfolio:

Current portfolio allocation:

25% of the holdings are from the Tech sector at the moment:

Weekly sector distribution:

Current portfolio (@finviz):

| Symbol | Name | Index | Sector | MC | Dist to 52w High | pct |

|---|---|---|---|---|---|---|

| CERN | Cerner Corporation | S&P 500 | Technology | 26.97B | -0.019 | 0.119 |

| ABBV | AbbVie Inc. | S&P 500 | Healthcare | 256.37B | -0.017 | 0.055 |

| MKC | McCormick & Company, Incorporated | S&P 500 | Consumer Defensive | 27B | -0.032 | 0.051 |

| MCK | McKesson Corporation | S&P 500 | Healthcare | 41.16B | -0.043 | 0.044 |

| CVX | Chevron Corporation | S&P 500 | Energy | 257.99B | -0.02 | 0.042 |

| VRTX | Vertex Pharmaceuticals Incorporated | S&P 500 | Healthcare | 59.18B | -0.093 | 0.042 |

| BPMP | BP Midstream Partners LP | Barrons 400 | Energy | 1.91B | -0.051 | 0.039 |

| CCMP | CMC Materials, Inc. | S&P 400 | Technology | 5.29B | -0.078 | 0.038 |

| HPQ | HP Inc. | S&P 500 | Technology | 40.3B | -0.079 | 0.038 |

| DLTR | Dollar Tree, Inc. | S&P 500 | Consumer Defensive | 31.1B | -0.083 | 0.036 |

| SFM | Sprouts Farmers Market, Inc. | S&P 400 | Communication Services | 3.3B | -0.063 | 0.031 |

| MCB | Metropolitan Bank Holding Corp. | Barrons 400 | Financial Services | 1.19B | -0.096 | 0.03 |

| HMST | HomeStreet, Inc. | Barrons 400 | Financial Services | 1.03B | -0.127 | 0.03 |

| MLI | Mueller Industries, Inc. | Barrons 400 | Industrials | 3.33B | -0.083 | 0.03 |

| EOG | EOG Resources, Inc. | S&P 500 | Energy | 64.46B | -0.03 | 0.028 |

| DY | Dycom Industries, Inc. | S&P 400 | Industrials | 2.76B | -0.161 | 0.026 |

| CVS | CVS Health Corporation | S&P 500 | Healthcare | 136.37B | -0.074 | 0.025 |

| BCC | Boise Cascade Company | Barrons 400 | Basic Materials | 3.22B | -0.067 | 0.025 |

| CHD | Church & Dwight Co., Inc. | S&P 500 | Consumer Defensive | 23.73B | -0.069 | 0.024 |

| CF | CF Industries Holdings, Inc. | S&P 500 | Basic Materials | 15.35B | -0.075 | 0.023 |

| QCOM | QUALCOMM Incorporated | S&P 500 | Technology | 192.21B | -0.147 | 0.021 |

| ANET | Arista Networks, Inc. | S&P 500 | Technology | 40.14B | -0.173 | 0.019 |

| FANG | Diamondback Energy, Inc. | S&P 500 | Energy | 22.68B | -0.045 | 0.019 |

| MRO | Marathon Oil Corporation | S&P 500 | Energy | 15.88B | -0.048 | 0.018 |

| CIEN | Ciena Corporation | S&P 400 | Technology | 10.42B | -0.185 | 0.018 |

| FLR | Fluor Corporation | S&P 400 | Industrials | 3.05B | -0.173 | 0.018 |

| CUBI | Customers Bancorp, Inc. | Barrons 400 | Financial Services | 2.1B | -0.201 | 0.018 |

| NUS | Nu Skin Enterprises, Inc. | S&P 400 | Consumer Defensive | 2.48B | -0.206 | 0.016 |

| DVN | Devon Energy Corporation | S&P 500 | Energy | 34.47B | -0.057 | 0.016 |

| BLDR | Builders FirstSource, Inc. | S&P 400 | Industrials | 13.51B | -0.205 | 0.016 |

| AA | Alcoa Corporation | S&P 400 | Basic Materials | 13.22B | -0.018 | 0.015 |

| APA | APA Corporation | S&P 500 | Energy | 11.61B | -0.118 | 0.015 |

| cash | Cash | Cash | Cash | – | 0.0 | 0.014 |

As always, more trades next week!